CASE STUDY

Agnew Capital Management Streamlines Portfolio Imports with Redtail Integration,

Triples AUM Since Adding YCharts

About

Terrance (“Terry”) Agnew, AIF®, MBA is the Principal and Founder of Agnew Capital Management. As an independent fiduciary firm, he provides investment management and financial planning solutions tailored to his clients’ unique needs and circumstances.

The Challenge

Terry’s day-to-day responsibilities revolve around managing and optimizing his clients’ portfolios. Looking to get away from manual processes related to portfolio management, he saw that the right software could scale his offerings to clients—and his business overall. “I needed something to help me automate portfolio construction and import holdings from my CRM, so I could spend more time putting together new portfolio options for my clients,” says Terry. At the end of the day, he wanted technology that would allow him to streamline repetitive tasks and free-up time to research new opportunities, compare different portfolio strategies, and tailor-make the ideal portfolios that address his clients’ needs.

As the sole proprietor at Agnew Capital Management, Terry was looking for an all-in-one platform that could also keep him updated on the latest market news, aid in generating new investment ideas, and elevate the presentation of his portfolios to clients and prospects.

Terry’s number one goal is for his clients to view him as a valuable and knowledgeable resource—and he knew the right technology could help him achieve that.

![]()

Almost everything I want to do, I can do within YCharts without needing to rely on other tools and breaking up my process. YCharts is my command center that drives my day-to-day analysis and decision-making.

The Solution

Terry first learned about YCharts at an advisor conference and subsequently enrolled in a free trial. Recognizing its utility and potential for his business, Terry onboarded YCharts in 2015 and never looked back.

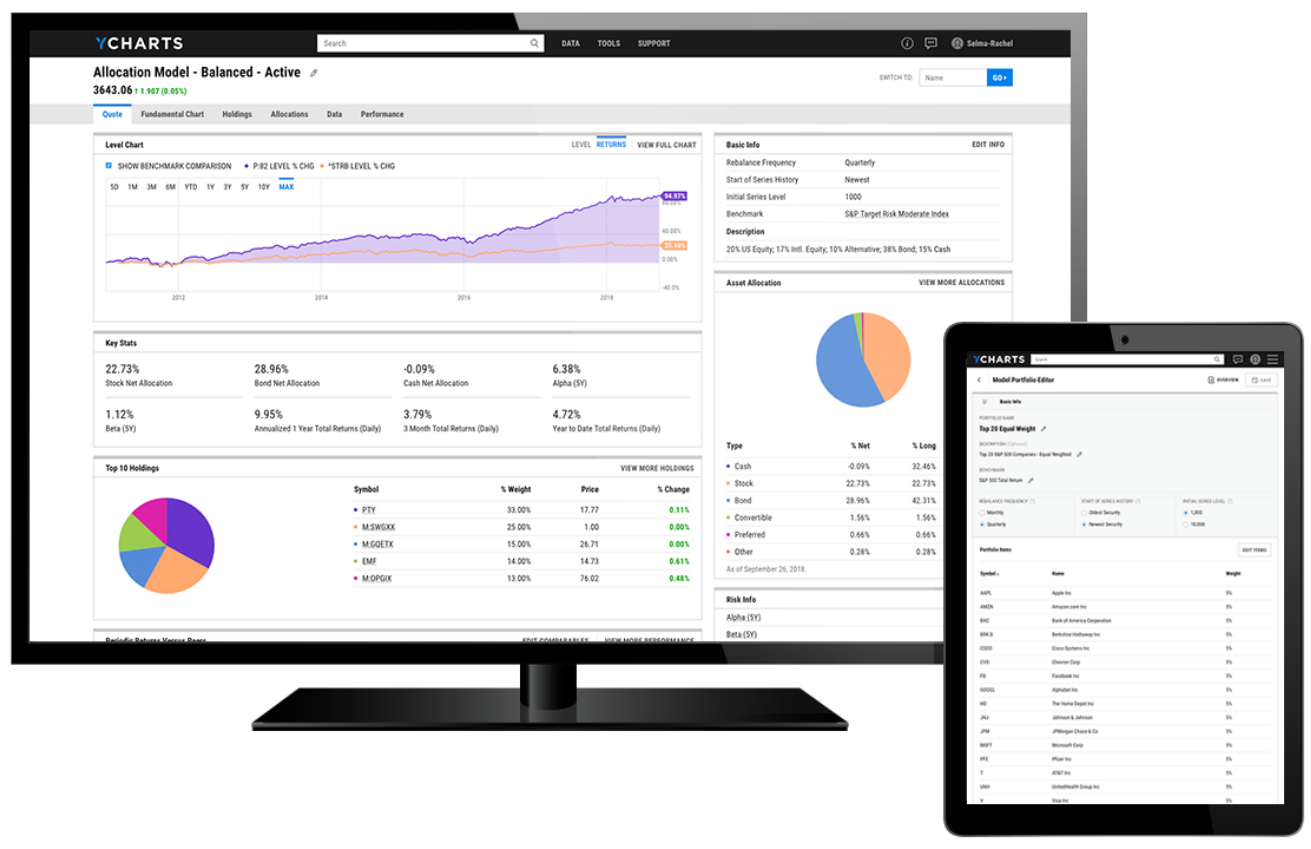

“The Model Portfolio tool has evolved so much through the years, and I’ve found even more value as it continues to be

refined,” says Terry. More recently, Terry has started utilizing the Redtail Portfolio Holdings Integration to efficiently import clients’ portfolio allocations into YCharts. “I appreciate that YCharts expands on Redtail’s capabilities so that I can perform my holdings analysis. It’s been a great partnership with each complementing the other’s strengths. It’s a major value-add for people who use both platforms like me.”

“With the Redtail integration, importing portfolio holdings is so much easier. I can just pull the data into YCharts when I need it and dig into the weeds to see which funds are providing the most value. That’s especially useful for comparing a proposed portfolio to a client’s original one,” says Terry.

Before using YCharts, Terry was trying to navigate three different investment research tools to complete singular tasks. Since making the switch to YCharts, he has not only consolidated his research process, but he’s also saving an average of $2,000 a year. Due in part to YCharts’ ongoing evolution, “the value-add that YCharts continues to provide significantly outweighs the cost,

especially for what I'm doing on a daily basis," says Terry. "Other platforms just can't compete with YCharts."

Speaking on YCharts’ navigation and user experience, “It’s a simple point, type, and click situation, and YCharts does the rest. It’s nothing like using a Bloomberg with its proprietary language and hardware. YCharts is easy to learn and intuitive to use.”

![]()

With the Redtail integration, importing portfolio holdings is so much easier. I can just pull the data into YCharts when I need it and dig into the weeds to see which funds are providing the most value. That’s especially useful for comparing a proposed portfolio to a client’s original one.

The Results

Terry leverages the YCharts Screener to identify funds that are best-suited for his clients’ portfolios, leveraging 4,000+ financial metrics to search through 18,000+ mutual funds and 3,000+ ETFs in YCharts. Focusing mainly on ETFs, Terry has discovered a number of new funds—and then added them to portfolio offerings—using the YCharts Fund Screener. “The biggest time savings comes from building out a fund screen and saving them to reference later,” says Terry. “Whether I’m screening for a specific category, like Large Cap ETFs with positive returns over the last 5 years, or ranking the Screen results using my custom Scoring Model, the Fund Screener has made me more efficient and helped me generate new ideas.” Terry has also realized significant time savings by setting Alerts on Fund Screens, which notify him of any new results matching his criteria.

Once he’s compiled a list of fund candidates, Terry adds them to Model Portfolios to build and test his portfolio strategies. “With the Redtail integration, I’ve got one less thing I have to worry about since inputting my holdings now feels automatic. There will be days when I have five or six tabs with different portfolio ideas open,” says Terry. “Most of my time now is devoted to curating the best combination of securities to deliver the best value to my clients.”

Terry uses the Dashboard to monitor his clients’ portfolios and other securities he’s still investigating as replacement opportunities. “YCharts is always up on my screen, and it’s something I rely on every day. It’s one of the first things I open up each morning,” he says.

“While I use it mainly for research and analysis, YCharts also makes it easy to create a proposal or generate a report for an upcoming meeting,” Terry says of YCharts’ FINRA-reviewed Portfolio Overview and Comparison reports. "The reports are chock full of information, and my clients get really excited when pouring through the data. As a marketing tool, the platform leads with its visuals and makes it easy for my clients, and especially prospects, to understand the data. They often don’t even need any additional explanation from me.” Simplifying his processes for importing portfolios from Redtail and preparing client-facing reports has allowed him to allocate more of his time to researching new funds and solidifying each of his client-specific portfolio strategies.

Agnew Capital Management has tripled its total AUM since adding YCharts to its tech stack. Terry highly recommends YCharts to fellow advisors in search of a comprehensive investment research platform. He adds that “YCharts is an advanced platform delivering tomorrow’s capabilities for today’s investors”.

![]()

While I use it mainly for research and analysis, YCharts also makes it easy to create a proposal or generate a report for an upcoming meeting … As a marketing tool, the platform leads with its visuals and makes it easy for my clients, and especially prospects, to understand the data. They oftentimes don’t even need any additional explanation from me.

Success Made With YCharts

Terrance Agnew, Principal & Founder of Agnew Capital Management, leverages YCharts to optimize his client portfolio construction and analysis, automate idea generation to streamline his fund research, and create visually appealing presentation materials to grow his AUM.