CASE STUDY

Asset Management Group, Ltd. Scales Its Portfolio Management Processes, Grows AUM by 15%

About

Ryan Hannifan is an experienced financial professional and Senior Portfolio Manager at Asset Management Group, Ltd. He is responsible for the firm’s portfolio management, strategy, trading, and planning functions. As an advisor, he believes it is vital that one’s firm can thoroughly explain portfolio strategies and results to all stakeholders to provide the proper guidance to their clients during periods of uncertainty. He holds degrees from the University of Wisconsin – Madison, with double honors in Personal Finance & Applied Security Analysis.

The Challenge

AMG relies heavily on performing in-depth investment research using Microsoft Excel—the backbone of its portfolio management processes. Ryan and his team were looking for a tool that would integrate well with their constructed spreadsheets and provide seamless continuity to avoid building new models from scratch.

![]()

The greatest challenge we face is sourcing, organizing, understanding, and communicating information in an unbiased and reliable way. Not only that, but we needed a comprehensive investment tool that allowed for scalable asset allocation solutions for our clients.

The Solution

Ryan first heard about YCharts through the likes of Michael Batnick, Ben Carlson, and Josh Brown who often cite data and visuals from YCharts on their podcast Animal Spirits and The Compound YouTube channel. Ritholtz’s visual, data-driven, and insightful content that leveraged YCharts provided Ryan with context of the platform's capabilities.

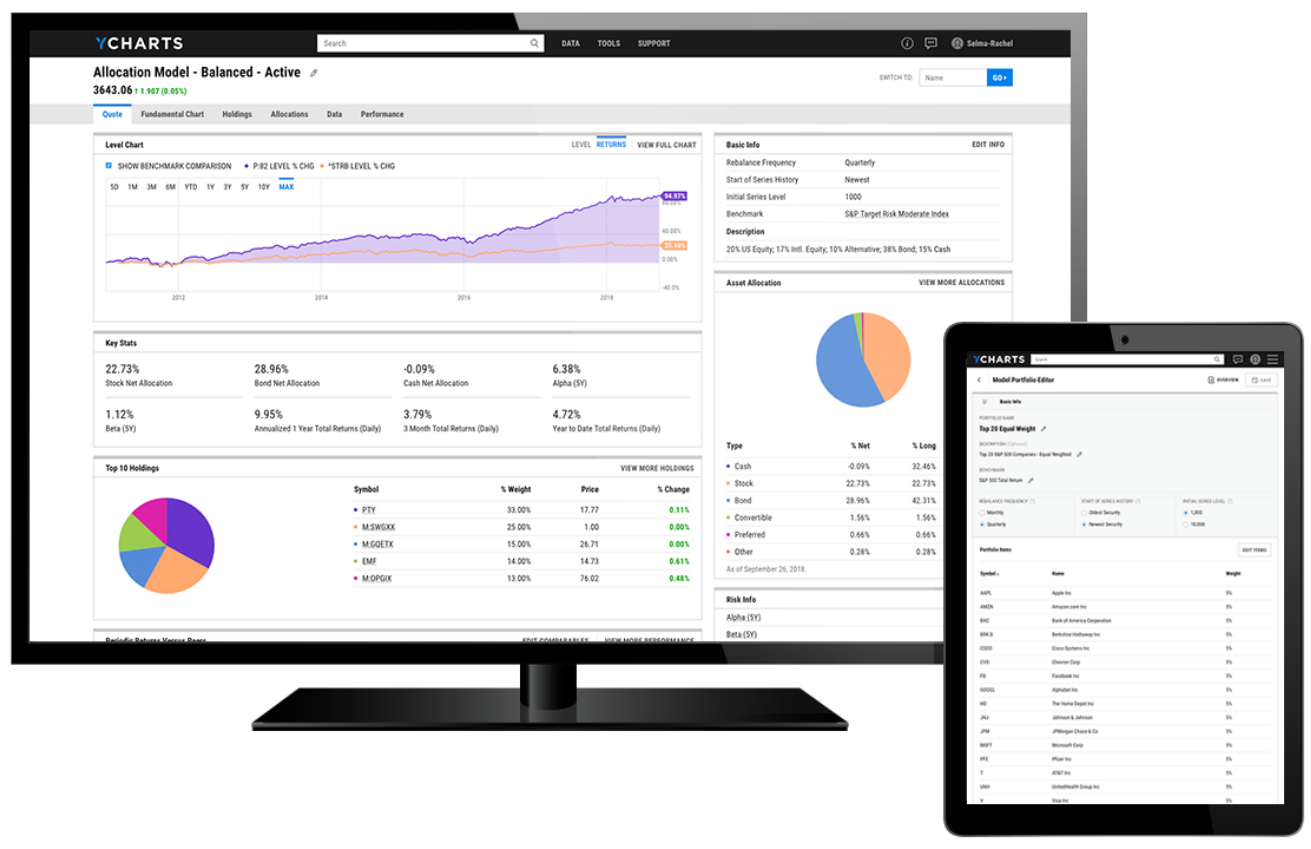

Once implemented into Asset Management Group’s operations, there was immediate value from YCharts’ visualization tools for securities, constructed portfolios, and economic datasets, and provided the firm’s advisors with professional touch-points when meeting with both prospects and clients alike.

“With all the securities that we’re currently buying and monitoring in one place, we’re able to keep a close eye on our clients’ holdings, lengthen the duration of our client meetings, and provide more robust financial planning outcomes for our

clients,” says Ryan of YCharts’ all-in-one form function. “We use YCharts for everything from asset allocation at the top – helping institutional investors figure out where to allocate money in a given year between growth or value, large or mid-cap, domestic or international – all the way down to the stock level using quantitative research.”

YCharts helps AMG draw objective investment conclusions and allows the firm to block out any unnecessary noise as the amount of data available in the industry is oftentimes overwhelming and difficult to navigate. “While comprehensive data is important, the value from YCharts comes from having the combination of superior data and the ability to analyze it to make informed decisions,” said Ryan. “While we can’t predict the future perfectly, we can help our clients make the decisions today that will look wise and prescient years from now when they look back.”

![]()

With all the securities that we’re currently buying and monitoring in one place, we’re able to keep a close eye on our clients’ holdings, lengthen the duration of our client meetings, and provide more robust financial planning outcomes for our clients.

The Results

Since Asset Management Group started using YCharts, they’ve leaned heavily on the platform’s Excel Add-In capabilities and its integration with their previously constructed workbooks. “YCharts’ Excel Add-In is crucial in our ability to demonstrate what a high-caliber, integrated, quantitative, and fundamental firm looks like. YCharts enables us to build upon our deep expertise and experience in data analysis and modeling – breathing life into once static quarterly reports with live data.”

Ryan and his team have developed a framework using YCharts’ Excel capabilities to enhance their day-to-day processes and built an in-house model to strengthen their investment selection methodology and support higher-quality collective decisionmaking. “At a high level, we wanted our approach to mimic the investment process of an army of research analysts, traders, and portfolio managers working around the clock. The goal is to visually communicate the variabilities between companies and across sectors in a way that resonates with reality, gets better as it scales, and is customizable for the preferences of the user.”

While Ryan is able to perform the deep analysis that he and his team needs, YCharts also empowers them with easy to generate and customizable reports with FINRA-reviewed Portfolio Side-by-Side Comparison Reports within YCharts’ Model Portfolio tool. “YCharts is crucial not only in powering our

practice management but in enabling us to share our thinking with clients in a way that is approachable and visually appealing,” states Ryan. With YCharts’ user-generated reports, AMG maintains an emphasis on tailored client education, but in a streamlined manner.

When asked about the biggest impact YCharts has made for their team, Ryan answered with one word: “Efficiency. AMG has become more efficient with its time since implementing YCharts across the firm. The amount of time saved because of this software has also saved our practice money and allowed us to scale faster than initially anticipated,” says Ryan. Now during client presentations, Asset Management Group’s client-facing teams can quickly analyze securities clients have questions about and share their insights on the spot with dynamic visuals using Fundamental Charts. Since implementing YCharts, AMG has grown total AUM by 15% with revenue experiencing a compounded annual growth rate of 7.5%.

“The industry needs more thought leaders who are willing to challenge the status quo. With the right tools like YCharts, investors are able to think outside of the box.” Ryan adds that, “We’ve got too many investors using the same traditional playbook of strategies. While there’s nothing wrong with following the same tried and true formula, we need more individuals who are willing to push the boundaries. With technology like YCharts, that’s possible. Without it, success is an uphill battle.”

![]()

AMG has become more efficient with its time since implementing YCharts across the firm. The amount of time saved because of this software has also saved our practice money and allowed us to scale faster than initially anticipated

Success Made With YCharts

As Asset Management Group, Ltd.’s Senior Portfolio Manager, Ryan Hannifan relies on YCharts to perform comprehensive research and analysis, construct boundary-pushing strategies, make objective investment decisions, and effectively educate his clients.