CASE STUDY

-png.png)

Meet Ben Peters, Principal, Lead Advisor & Chief Compliance Officer at Burton Enright Welch

About

Celebrating its 30th year of service in 2019, BEW is a California-based independent investment management firm with a team of six advisors managing over $700 million in client assets. Working with anyone from high-net-worth clients to families with smaller nest eggs, BEW serves clients in 28 states across the country. In addition to investment management, BEW also offers financial planning and retirement plan services.

The Challenge

The most precious resource for today’s investment managers is time, and Ben Peters, a BEW financial planner who also serves as Chief Compliance Officer, realized that the company’s investment research process was in need of modernization. As many advisors today do, Ben wears many hats at BEW. Not only was it difficult and time consuming to perform deep dives on stocks and funds with the disparate resources BEW was using, it was also challenging for Ben and the whole BEW team to communicate complex investment ideas to clients in a clear, easy to-understand manner.

While BEW wasn’t necessarily shopping for a new investment research tool, Ben knew he needed a solution to address inefficiencies at the firm. Having previously used other tools he described as “clunky,” Ben needed a nimble system that would facilitate a scalable process for both portfolio- and security level analysis. After reading about YCharts on industry blogs and taking a demo at an advisor-focused conference, Ben brought the idea of using YCharts to his team, and they decided the potential benefits of the platform were worth a closer look.

![]()

YCharts enables us to visually depict why we think it’s important to diversify, which really gives us an opportunity to add value.

The Solution

Ben and his team saw value in YCharts, particularly with the YCharts Excel Add-In report templates, and decided to move forward with YCharts Enterprise.

Ben was especially pleased with the customer support team, which was ready and able to answer all questions in a timely manner throughout onboarding.

“The platform is pretty user-friendly, but whenever I do have questions, the chat feature is super helpful,” said Ben. “The support reps are really onpoint and very knowledgeable.”

After getting started with some bespoke Excel Templates, Ben’s team took their YCharts usage to a new level. Soon after the firm got started on the platform, Jake Moller, another of BEW’s financial planners, began to use the YCharts Excel Add-In extensively to build customized slides, which automatically pull in the latest market data, for client presentations.

“Jake uses YCharts to explain our investment ideas and tell the story of how data backs up our strategies,” said Ben.

“We’re able to use fresh data and customize the look and feel of our reports, which is very powerful.” In the past, BEW relied on data found in free, online resources or performance figures provided by fund

wholesalers. Now, with YCharts, Ben and his team are able to recommend strategies to clients with unbiased third-party data and highlight the metrics that are most relevant to each individual client.

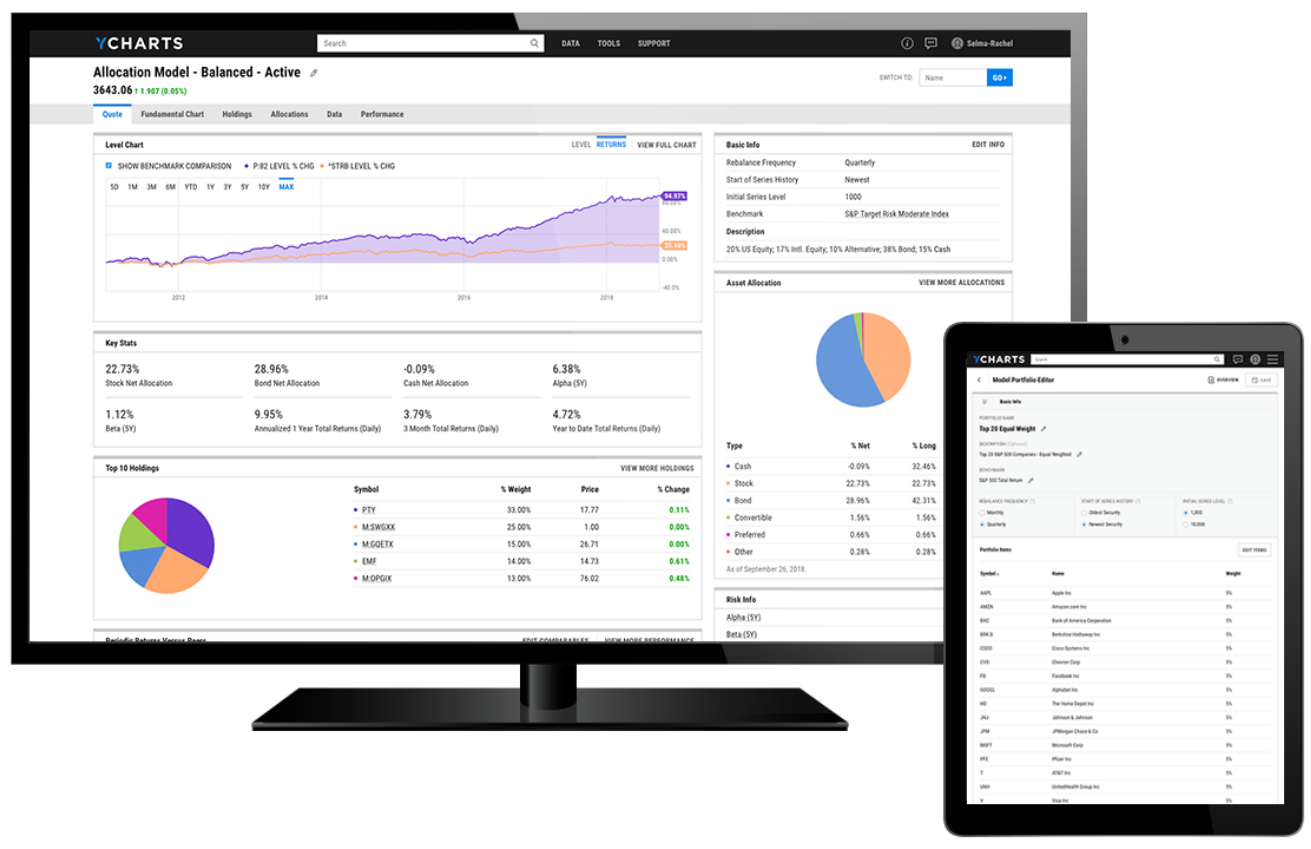

The BEW team also uses YCharts Model Portfolios for visualizing the hypothetical performance of portfolios and tracking and managing the model strategies put forward by the investment committee. Ben adds that he uses Model Portfolios to provide an overview of models’ performance to BEW’s investment committee and to evaluate portfolios from different angles.

![]()

I really appreciate having the ability to arm myself with necessary analysis to bring to the team and push on certain trades we want to make.

The Results

Over more than a year of using the platform, BEW has found YCharts to be a cost-effective solution for their practice, adding seats to its license as the BEW team grows. Even while investment management is just one of the many services BEW provides, the team members still use YCharts every day to ensure they are making smarter investments on behalf of clients.

For example, many of BEW’s clients hold portfolios that consist of concentrated stock positions of a large local employer.

While the shares have exploded in value and paid a healthy dividend, BEW uses YCharts’ data and tools to create a narrative explaining the risks of a single stock portfolio and offering strategies that best suit their clients’ needs and goals.

“With these clients that have legacy, single stock positions, YCharts enables us to visually depict why we think it’s important to diversify, which really gives us an opportunity to add value,” Ben said. “We can show historically how similar situations have played out.”

BEW’s ability to use YCharts for simplifying complex financial data and relaying information to clients in a visual and intuitive manner has been extremely valuable for client communications.

And BEW has found that the use cases are continuing to accumulate. Whether quickly using the Dashboard and Company or Fund Quote Pages to evaluate specific securities, building charts and tables to perform deep dives on investment ideas, or demonstrating strategies in action during client presentations, BEW is taking advantage of the platform in more ways than the firm previously envisioned when it first added YCharts to its technology stack.

“Once we pulled the trigger on it, we used the heck out of the platform,” Ben said. “I really appreciate having the ability to arm myself with necessary analysis to bring to the team and push on certain trades we want to make.”

Ben added that YCharts has built confidence and focused the discussion around investments and portfolio management in a way that’s much more productive, creating more and better opportunities for BEW to help its clients.

“YCharts is a really elegant way to monitor our portfolios and it has demonstrated its value multiple times in helping us communicate with clients,” said Ben. “I’m expecting our use will only grow as we move forward and as YCharts continues to add features and functionality.”

![]()

YCharts is a really elegant way to monitor our portfolios and it has demonstrated its value multiple times in helping us communicate with clients. I’m expecting our use will only grow as we move forward and as YCharts continues to add features and functionality.

Success Made With YCharts

Adding YCharts to its investment process has enabled BEW to more effectively monitor client portfolios, communicate investment ideas, and improve decision making within the investment committee.