CASE STUDY

Meet Andrew Comstock, President and Chief Investment Officer at Castlebar Asset Management (now Beyond Wealth)

About

Castlebar is an RIA, wealth management, and financial planning firm in the Kansas City area, with approximately $30 million in assets under management. The firm integrates financial planning and investment management into a cohesive strategy for clients holding their assets at Charles Schwab. Leveraging the latest technology, Castlebar is able to deliver high-quality customer service.

The Challenge

Employing a blend of active and passive investment strategies, Andrew Comstock, President and Chief Investment Officer at Castlebar, needed a cost effective, powerful platform for financial data and research. As a user of a Bloomberg Terminal for many years, Andrew was ready for a more innovative option that provided index data and economic information that could streamline his firm’s research processes.

In an industry where simultaneously new RIAs are popping up while legacy firms are consolidating, Andrew realized that he needed to stand out in an increasingly competitive marketplace. He came to the realization in 2012 that innovative technology could be a unique selling point for his firm to cement relationships with customers.

He couldn’t continue to stomach the high costs of Bloomberg, but didn’t feel confident in the depth or breadth of capabilities of Yahoo! or Google Finance. Finding an option that had the right balance of compelling capabilities and an appealing price was key for helping Andrew elevate Castlebar to the next tier of RIAs.

“By showing clients you are investing in new technology to help them, you’re really giving yourself an opportunity to differentiate from other firms,” said Andrew. “You simply can’t guarantee accuracy and information on free tools, so we knew we needed to pivot.”

![]()

By showing clients you are investing in new technology to help them, you’re really giving yourself an opportunity to differentiate from other firms.

The Solution

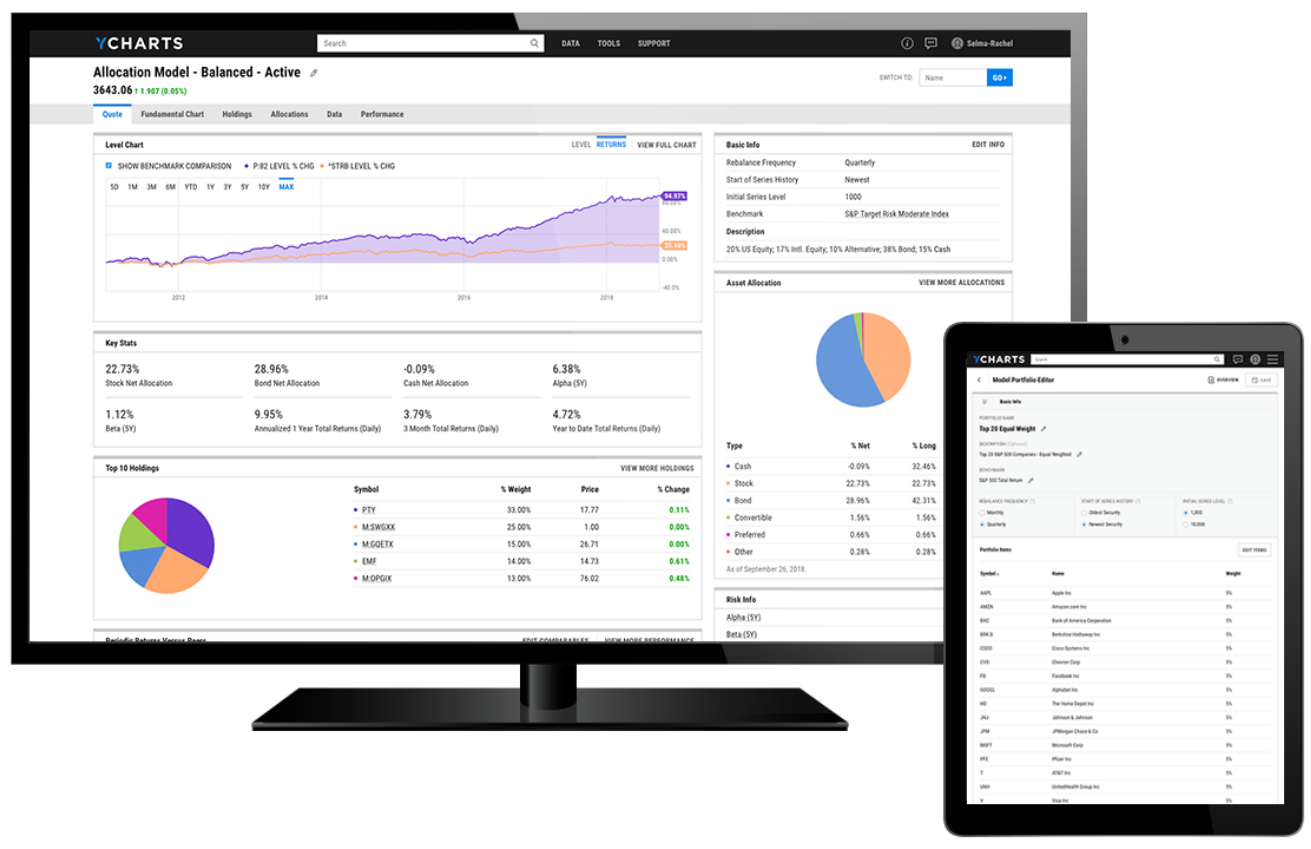

When he first learned about YCharts in 2012, Andrew quickly came to the conclusion that it was the best next step for his business. After a smooth transition onto the platform, Andrew and his team were up and running in short order, and YCharts was immediately providing custom spreadsheets and delivering tools that enabled smarter investments.

As a self-proclaimed Excel junkie, Andrew was especially pleased with the Excel Add-in, an extension of the YCharts tool that allows customers to create a model once, then update it with a single click. “With YCharts, it’s kind of like having a super intern or extra analyst that we can send data to in order to create new spreadsheets, models, etc.,” said Andrew.

“When we saw how powerful the Excel Add in was and the high ROI we attained, it became a real sweet spot for us. The amount of information we could pull into it was great, and keeps getting better.”

In addition to the Excel Add-in and financial data, Castlebar also uses YCharts’ Stock and Fund Screeners to run queries for specific US/Canadian securities. Castlebar saves these queries and runs them on a regular basis to conduct ETF research, perform ongoing portfolio analysis, and prepare client communications.

When securities hit certain prices, Andrew and his team are able to quickly make alpha generating investments with the help of YCharts’ alerts and screeners, taking advantage of the platform’s data quality.

![]()

YCharts saves us several hours a week. We are very process-driven, and with its tools, YCharts gives us an effective, all-encompassing solution that we rely on to make us more efficient.

The Results

Andrew thought that transitioning from the Bloomberg Terminal to YCharts may cost him some of the data and functionality that he needed, but he found that YCharts is providing all the value he needs and more. Given the cost-effectiveness of YCharts’ solutions, the team at Castlebar instituted YCharts as part of its day-to-day processes.

“We have a finite number of hours, and YCharts helps us get the most out of those hours,” said Andrew. “YCharts saves us several hours a week. We are very process-driven, and with its tools, YCharts gives us an effective, all encompassing solution that we rely on to make us more efficient. Instead of needing to check multiple sites and use multiple different tools, we can spend that time communicating with clients.”

Whether Andrew is looking for indices, mutual fund, ETF, stock, or economic data, he turns to YCharts. Additionally, he knows that when he needs help with custom Excel templates or wants to learn about newly added features and functionality, all he needs to do is ask.

“Amazing customer service and product development are added bonuses to using YCharts,” said Andrew.

“My account manager regularly checks in and lets me know about some really awesome features and new data that I can use to save even more time.”

“It’s a great technology platform that we use every day to run our firm more efficiently, and for the price, you can’t beat it,” added Andrew.

![]()

It’s a great technology platform that we use every day to run our firm more efficiently, and for the price, you can’t beat it.

Success Made With YCharts

These solutions enable smarter investing for Castlebar and give the team hours back each week.