CASE STUDY

Cetera Investors Elevates Its Investment Research & Client Communication With YCharts

.png?width=400&name=Ryan%20Miller%20(400%20x%20400).png)

About

Cetera Investors, a marketing name of Cetera Investment Services LLC, provides financial planning and wealth management services with a mission to develop tailored investment plans driven by their clients’ needs, wants, and long-term goals. Cetera’s advisors strive to educate their clients in an easy-to-understand manner and empower them to be involved in pursuing their financial aspirations. Ryan Miller, RICP, has been a financial advisor at Cetera Investors since 2019, has nearly 20 years of experience in the financial services industry, and is a graduate of Cornell University.

The Challenge

Ryan joined Cetera Investors after the brokerage and investment advisory units from his previous firm were purchased by Cetera Investment Services in 2019. As part of the transition, Ryan and his team had to repaper all of their advisors' accounts into Cetera’s platform.

Two of Cetera’s other research tools that Ryan was using at the time met most of his needs, but there were some growing pains. With Ryan heavily leveraging Separate Accounts (SMAs) in his client portfolios, the reporting frequencies available oftentimes came up short. Additionally, the securities search function was less-than-intuitive, returns data didn’t always match up with strategist sheets, and the relatively slow portfolio calculations all derailed Ryan’s productivity.

“I was looking to build out roughly ten different models that I could monitor efficiently,” says Ryan. “All I needed was a research platform that could keep up with me and provide me with accurate returns and drawdown data, so I could make sure my clients could easily understand the strategies we were utilizing.”

Having lived through the 2008 financial crisis early in his career, Ryan recognized that the 2020 pandemic was a similar reminder that robust strategies are needed to withstand the most hostile market conditions. To do that, he needed a platform that would allow him to perform comprehensive research efficiently and effectively.

![]()

All I needed was a research platform that could keep up with me and provide me with accurate returns and drawdown data so I could make sure my clients could easily understand the strategies we were utilizing.

The Solution

“I was introduced to the platform during a conference hosted by Potomac Fund Management where I got to see the power of YCharts first-hand,” says Ryan. “What sold me was the report functionalities and Comp Tables. Everything just looked super clean and client-friendly. Plus, everything could be exported to Excel for easy tracking. I immediately recognized the potential for significant time-savings.”

Soon afterward, Ryan signed up for a free trial to test drive YCharts’ research capabilities for himself and immediately recognized the impact the platform could have on growing his business. He and a colleague out of Buffalo within the Cetera Investors network added YCharts to their tech stack soon afterward.

“The twenty or so advisors under the Cetera Investors umbrella run a lot of the same models,” says Ryan. “YCharts’ sharing capabilities were a game-changer. We were able to build out and replicate the same models for a number of our clients - saving us from having to start from scratch.”

With the help of YCharts’ customer support team, Ryan was also able to create a custom report template that highlighted performance and risk metrics he discusses most often, including annualized return, drawdown, standard deviation, and beta. From there, it took just a couple clicks to generate a report before each client or prospect meeting. “What used to take me 2-3 minutes to prepare previously is now down to around 15 seconds,” says Ryan. “ That might look like just an incremental amount of time back in my day-to-day, but it adds up.”

![]()

What really sold me was the report functionalities and Comp Tables. Everything just looked super clean and client-friendly... I immediately recognized the potential for significant time-savings.

The Results

Since onboarding with YCharts, Ryan has realized significant time savings. Research that used to take up to 10 hours per month is down to 1-2 hours. He attributes Comp Tables with streamlining several of his processes and frequently leverages saved metric sets to quickly analyze any peer group or holdings list. Ryan also leans on the Excel Add-In to help track the firm’s various models.

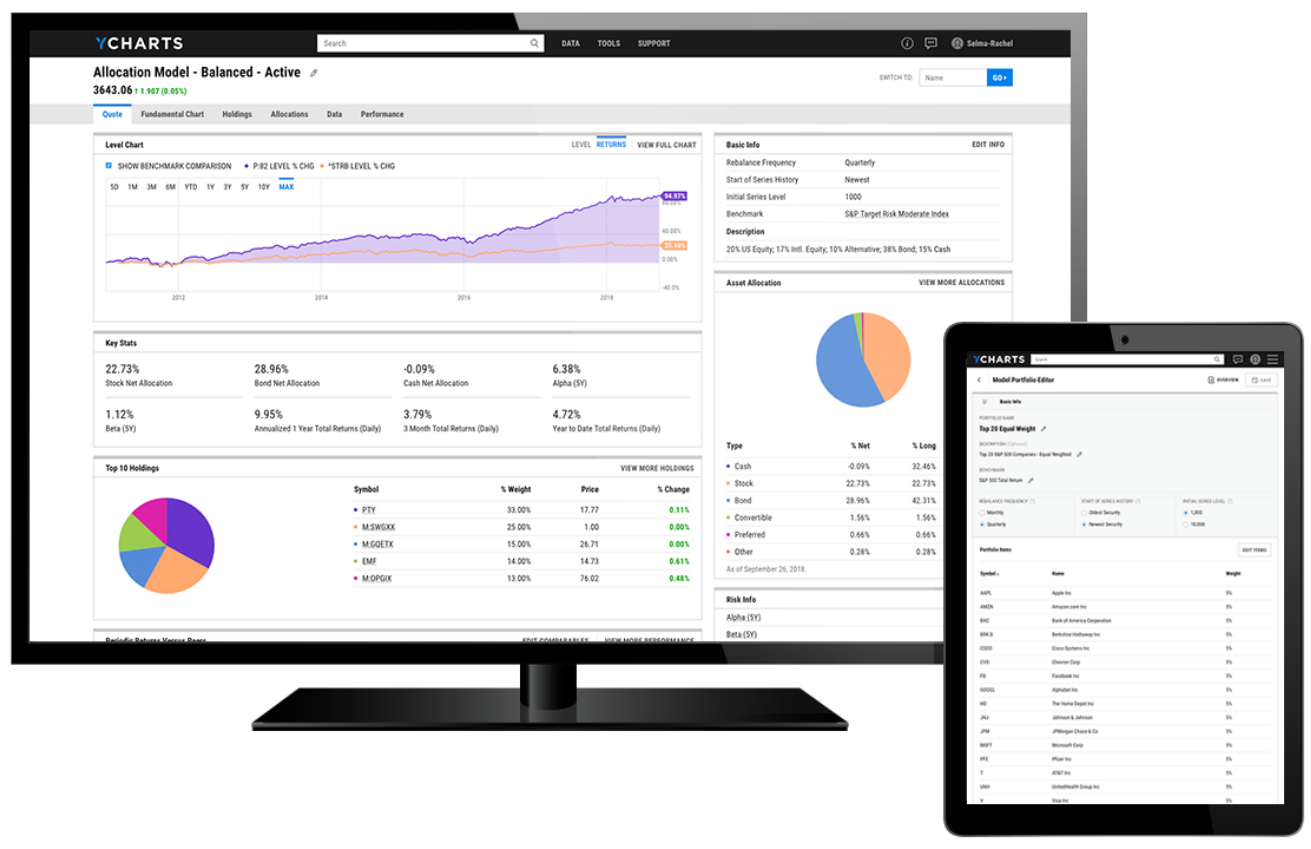

YCharts Model Portfolios simplified the process of comparing a prospective client’s existing portfolio to a tailored investment strategy Ryan recommends. “YCharts made it easy for me to provide clients a direct comparison of their current asset allocation against our proposed solution,” says Ryan. “I can more directly speak to drawdown and return metrics for my clients and paint a clear narrative of what areas can be improved upon.” This has led to improved conversions of direct investment accounts to our advisory platform which has freed up more time to help clients with other aspects of financial planning.

Ryan noted that for virtual meetings, the charting tools are a favorite amongst clients to spur engaging conversations. “Being able to visually narrate the positive impact of a strategy using either Fundamental Charts or Scatter Plot was a game changer,” says Ryan. “I’m now able to compare the performance of a client’s current holdings against a proposed model or index of interest in addition to performing stress tests or updating a chart’s date range all on-the-fly.” Being able to provide his clients with an easy-to-understand visual helped strengthen his recommendations while solidifying their confidence in him as their advisor.

“Looking at all the other options out there, YCharts is best-in-class. Second place isn’t even close from a research standpoint and client-facing tool,” says Ryan.

![]()

Looking at all the other options out there, YCharts is best-in-class. Second place isn’t even close from a research standpoint and client-facing tool.

Success Made With YCharts

Ryan Miller, RICP, relies on YCharts to streamline portfolio research and analysis, so he can spend more time understanding his clients’ needs and provide high-quality financial planning.

.png?width=1375&height=413&name=Cetera%20(6).png)