Encompass Financial Advisors Experiences 25% Growth in AUM,

Relies on YCharts for Financial Research & Analysis

.jpg?width=3738&name=Pat%20Passon%20Headshot%20(square).jpg)

About

Pat Passon has over 30 years of experience as a financial advisor. After beginning her career in materials management, she pivoted to wealth management after a less than positive broker experience stoked her desire to provide others with better financial and investment advice. Pat started her financial advisory career at a larger, traditional firm but quickly realized she wasn’t interested in the sales and commissions side of the business, eventually breaking out on her own in 1993 as a fee only sole proprietorship. In 2004, Pat relocated her practice from California to Oregon and subsequently incorporated as Encompass Financial Advisors, Inc. in 2005.

The Challenge

Whether generating new investment ideas or identifying the right funds for a client portfolio, Pat needed a research tool that was both robust and intuitive to navigate. As the sole operator of her practice with no research team to call on, she is a true “do-it-yourself-er” and needed an all-in-one investment research and client communications platform.

“Much of my time is spent performing in-depth investment research and portfolio analysis,” says Pat. “When appropriate, I look for opportunities to put

more money to work and must find the funds & ETFs that align with my client’s risk profile and need for income,” she added.

Prior to using YCharts, Pat didn’t have the best experience with other software, noting the removal of certain features that she heavily relied on for her clients’ success, as well as a declining user experience. She was determined to find a solution that would meet her needs and come at a better price point.

![]()

Most of my time is spent performing in-depth investment research and portfolio analysis... I look for opportunities to put more money to work and must find the funds & ETFs that align with my client’s risk profile and need for income.

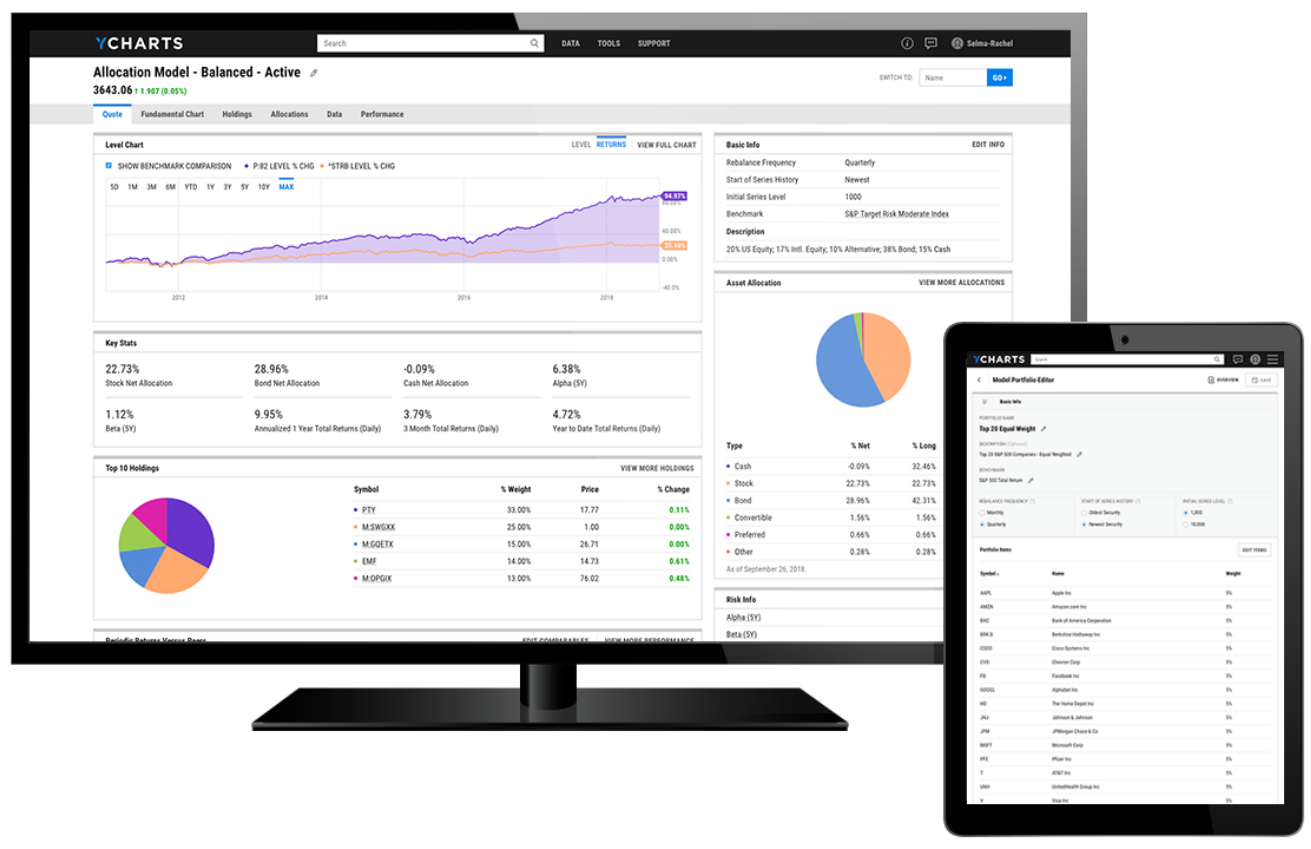

The Solution

Pat was aware of YCharts for a few years and had consistently heard good things. When the provider of her previous research software changed core features for unknown reasons, she knew it was time for a change and immediately saw the value in YCharts.

“YCharts allowed me to perform deep dives on funds and ETFs to identify those best-suited for my clients. Whether comparing distribution yields to maximize income or right-sizing a portfolio’s allocation to international investments, YCharts makes research more accessible and readily available,” says Pat. She adds that, “there's similar data available on other platforms, but YCharts gives me more information and makes it easier to digest.”

Additionally, Pat expressed her appreciation for the YCharts customer support team throughout the vetting process, saying “they’ve been great in answering my questions and educating me on which tools I should use to perform targeted research and analysis, and how to be more efficient.”

From the easy-to navigate interface to the above and beyond customer service, Pat found that YCharts addressed or surpassed all her fundamental research needs. The platform is core to the value Pat offers her clients—and core to managing her practice as a solo advisor.

![]()

Whether comparing distribution yields to maximize income or right sizing a portfolio’s allocation to international investments, YCharts makes research more accessible and readily available.

The Results

At each step of Pat’s process, she utilizes YCharts to perform extensive research and make more informed decisions. She continues to be impressed by YCharts’ ease-of use in finding the data points and financial metrics she needs to build and manage portfolios, day-in and day-out. On top of that, she’s been able to educate her clients on fund performance using Fundamental Charts, visually highlighting historical performance leading into, during, and after recessionary periods.

Pat uses YCharts Quickflows which condense popular research workflows into single-click efforts —to spark ideas and verify her market views. “With Quickflows, I find myself going down the rabbit hole, uncovering new information about securities and even additional ways to analyze them,” noted Passon.

To build better risk based client portfolios, Pat streamlines her funds and ETF identification

process using the YCharts Fund Screener and the over 4,000 financial metrics available. Pat says that “YCharts’ Fund Screener is more comprehensive and easier to use than other platforms, allowing me to drill down into funds at a granular level.”

In addition to constructing client portfolios, Pat uses YCharts Model Portfolios to expedite her portfolio evaluation process and imports client portfolios to access more robust analytics in YCharts. While she eans on Model Portfolios to oversee client strategies, she hopes to utilize the tool’s clientfriendly PDF reports to simplify her reporting and connect the dots for her clients.

“YCharts has broadened my research capabilities, and I’ve just barely touched the surface of what’s available,” said Passon. Since implementing YCharts, Encompass has grown assets under management by 25%.

![]()

With Quickflows, I find myself going down the rabbit hole, uncovering new information about securities and even additional ways to analyze them.

Success Made With YCharts

As a fee-only, fiduciary, and independent advisor, Pat Passon, CFP®, MBA of Encompass Financial Advisors, Inc. counts on YCharts to perform comprehensive research and analysis, educate her clients, and ensure she’s offering the best financial advice possible.