CASE STUDY

-png.png?width=1398&height=215&name=kkm%20%20(1)-png.png)

Meet Jeff Kilburg, CEO of KKM and TV personality

About

As a regular contributor on CNBC’s Halftime Report, in addition to his full-time job as CEO and portfolio manager at independent investment solutions firm KKM Financial, Jeff wears many hats. Servicing clients with a proactive, risk-managed approach by utilizing dynamic stock selection, hedging, option-overlay, and ETF model portfolios, Jeff and his team at KKM focus on portfolio management and hedging solutions for wealth advisory firms, family offices, and institutions.

The Challenge

It’s been seven years since Jeff founded KKM, and around that same time, he made his first appearance on CNBC, when he correctly predicted that the 10 year note would fall to historic lows under the 1.5% level. Jeff’s whole career has been centered around the markets and uncovering investment and trading opportunities, something that he has excelled at over time and that served as inspiration for founding KKM.

With the industry changing, advisors are increasingly asked to be planners, relationship managers, sales reps, and even therapists from time to time, and thus portfolio management often falls by the wayside.

“KKM uses a research based approach to supplement advisors’ strategies by providing liquid, risk-managed exposure to global equity markets, relieving advisors of some portfolio management burdens. Since its inception, KKM has continued to add to its strong team and reputation, but the one thing missing was an investment research solution that would be as quick and nimble as the firm.

Jeff knew a Bloomberg terminal wasn’t the answer and couldn’t devote the many hours needed to learn the complex syntax, keystrokes, and buried functionalities of the tool. Until he came across YCharts, he wasn’t always able to have the data he needed at his fingertips.

![]()

With YCharts, I’m able to quickly monitor key holdings and big movers, in addition to researching mutual funds and comparing them to sectors or single stocks.

The Solution

Jeff has known about YCharts since the early days, but aside from the basic functionality, he never really drilled down into the capabilities of the platform until the past few years. When he did, he was pleasantly surprised to find that YCharts was an integral tool he could use for research and preparation for his work at KKM and his appearances on CNBC.

“Both on the air and off, I’m constantly scrubbing stocks that are KKM portfolio components to make sure I’m staying on top of the market, especially during earnings announcements,” said Jeff. “With YCharts, I’m able to quickly monitor key holdings and big movers, in addition to researching mutual funds and comparing them to sectors or single stocks.”

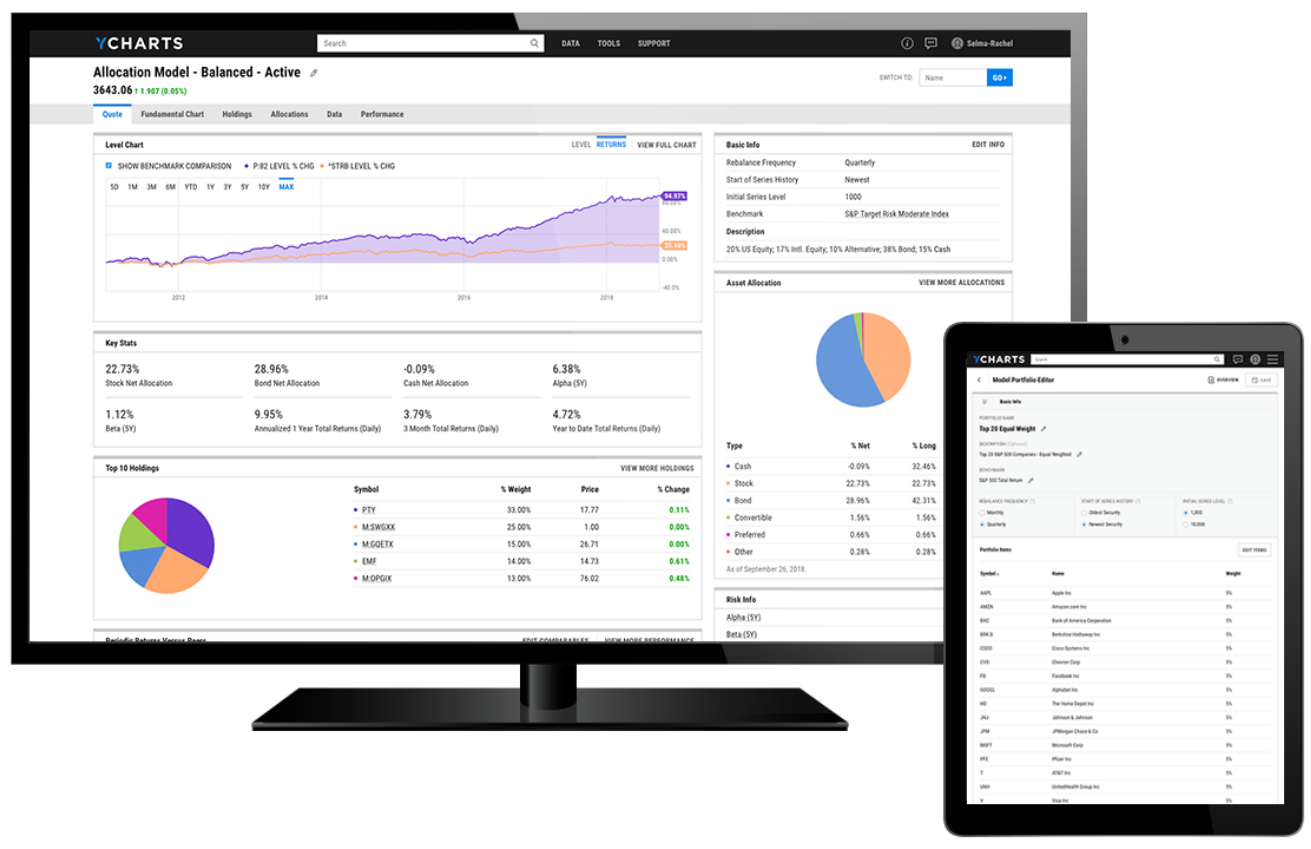

Stock and fund screening is just the tip of the iceberg for how Jeff utilizes the platform. The Comp Tables tool enables him to show colleagues and clients security comparisons to determine which ones may be better or worse for a specific investment strategy, while Fundamental Charts help Jeff communicate data-driven insights about a stock, mutual fund, or ETF to his clients.

“I remember a specific time in which one of my clients was talking to me about how he thought a certain ETF was a great investment,” said Jeff. “In real-time, while we were on the phone, I sent him a Fundamental Chart that showed how our KKM Essential 40 ETF was outperforming that ETF and convinced him to consider a new strategy. YCharts really provides a simple way to demonstrate investment performance.”

Since we launched our Model Portfolios tool in October 2018, over 11,000 model portfolios have been built, and Jeff is one of the portfolio managers behind that statistic. With KKM’s ETF model portfolios powered by Nasdaq Dorsey Wright, Jeff and his team are able to tinker with ideas using the tool and

visualize their hypothetical performance.

“Putting holdings into YCharts to analyze weights and performances gives us the ability to build out strategies that aren’t publicly available and then analyze whether they’re worth pursuing,” said Jeff. “Previously, everything was ad hoc in Excel, and it was a really slow-moving process. Now, constructing new portfolios for clients is easy, efficient, and much more manageable.”

![]()

Previously, everything was ad hoc in Excel, and it was a really slow-moving process. Now, constructing new portfolios for clients is easy, efficient, and much more manageable.

The Results

Jeff can’t imagine life without YCharts. It’s proven to be a trusty resource, even when he’s been asked to pivot during his live appearances on CNBC.

Earlier this year, when Jamie Dimon spoke at the Economic Club of New York, Jeff’s regular segment on Halftime Report was cut short. and he had to quickly shift gears to comment on Dimon’s thoughts about cybersecurity.

During a two-minute commercial break, Jeff opened YCharts to find a data point about Palo Alto Networks that he used to provide meaningful insights to the audience. It’s the little use cases in which Jeff is able to find “insightful nuggets” that make YCharts invaluable, Jeff told us. Jeff’s also noticed that YCharts has made a substantial impact on KKM’s ability to meet client needs.

“YCharts has dramatically helped us educate the majority of our clients, all of whom have different needs and focuses,” said Jeff.

“Using YCharts, we’re able to help them understand something quickly using a table, picture, or chart."

"Rather than trying to explain with words, which could take 20 minutes, showing data and graphics in YCharts helps them see the value in KKM’s offerings.”

He absolutely believes that YCharts is an ultra highROI tool, telling us that he saves at least four hours per week of his time researching investments, leaving him more time to service his clients and prep for his TV appearances.

“If you’re looking for a more time-efficient and robust way to research or construct portfolios, YCharts is going to save you a lot of time,” Jeff said. “Sometimes your research may require diving deeper, and as you continue to squeeze out the efficacy of your business, YCharts is going to help you claw back time.”

![]()

Using YCharts, we’re able to help them understand something quickly using a table, picture, or chart. Rather than trying to explain with words, which could take 20 minutes, showing data and graphics in YCharts helps them see the value in KKM’s offerings.

Success Made With YCharts

Leveraging YCharts to research investments continues to provide value for Jeff in his analysis for CNBC and has enabled his team at KKM to deliver smarter investment opportunities for clients.