CASE STUDY

-png.png)

Meet Jeff Duckworth, President of Intermediary Distribution &

Matt Blandford, Sr. VP & Divisional Sales Manager at John Hancock Investment Management

About

It’s the job of Jeff Duckworth, President of Intermediary Distribution, who leads the firm’s 59 person wholesaler team that services broker dealers nationwide, to continue delivering investment strategies that help advisors enable their clients to reach their financial goals. Following Jeff’s lead, Matt Blandford, Senior Vice President - Divisional Sales Manager, is responsible for driving the success of 11 wholesalers throughout the Midwest. With YCharts integrated as a sales enablement tool powering John Hancock’s distribution team, wholesalers are performing on-the-fly analysis to keep the momentum going during sales meetings and drive increased asset growth.

Jeff and Matt employ a capital markets-centric approach and work with advisors to help solve investment management challenges. What makes John Hancock unique from other asset managers is their ability to offer a range of solutions managed by a diverse set of specialized asset managers, many of whom have spent their careers refining a single winning strategy.

The Challenge

An advisor’s time is scarce, so it’s critical that wholesalers provide as much value as possible while reducing the potential for friction during meetings. To maximize the impact of their opportunities to communicate with prospects, wholesalers need to have access to data and tools that enable real-time sharing of information about funds, the current market environment and model strategies.

As a forward-looking team, John Hancock is constantly working on ways to help its wholesalers have data-enabled conversations with advisors about risks in their investment strategies. Jeff saw an opportunity to fill a gap in the distribution team’s engagement strategy with a platform that his team can use on-the-go with real-time access to data and visuals.

![]()

YCharts is helping us bring more focus to the conversations we have with advisors, including helping them see the potential value in making changes to their portfolio strategies.

The Solution

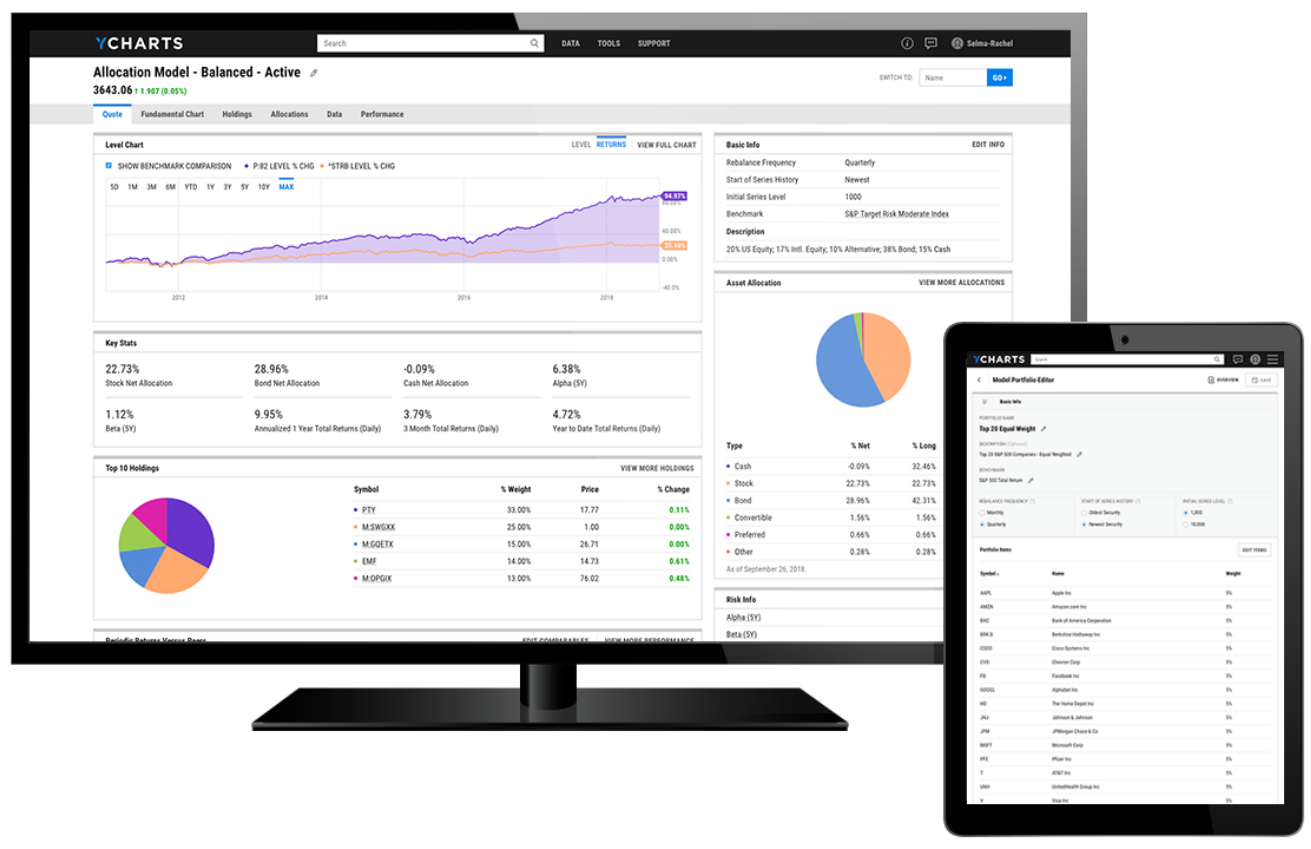

After learning about YCharts through the recommendation of an industry peer, John Hancock decided to outfit the company’s distribution team with the platform. Motivated by the desire to keep wholesalers abreast of market and fund flow movements; visualize economic trends; deliver timely market research and analysis; highlight model portfolio solutions; and objectively address challenges that may arise during meetings, John Hancock felt YCharts provided a compelling solution.

“With YCharts, we’re able to better put our investment solutions in the context of the markets in a way that works for people on the go,“ said Jeff. “It’s an incredibly analytical tool and saved us from having to build one in house.”

When meeting with advisors, John Hancock’s wholesalers take a consultative approach. By first assessing their needs, the distribution team gains an understanding of advisors’ current strategies and how John Hancock could improve them.

YCharts’ Fund Screener enables the firm’s wholesalers to compare funds by category and analyze performance and risk metrics, allowing them to uncover funds that stand out as strong investment opportunities.

Additionally, the John Hancock distribution team is building their own client fund lists directly into YCharts, which their wholesalers can then leverage for powerful on-the-fly analytics and strategically weave into sales conversations. The tool provides the ability to quickly create visuals that showcase the hypothetical performance of potential strategies compared to the advisor’s current strategy, in clean, visually appealing, branded reports.

“YCharts is helping us bring more focus to the conversations we have with advisors, including helping them see the potential value in making changes to their portfolio strategies,” said Jeff.

And it’s not just the YCharts tools that are making an impact. Jeff and Matt both make sure that their wholesalers are leveraging YCharts’ Fund Flows Report to ensure they’re up-to-date on the previous month's fund flow numbers, historical flows and performance data for mutual funds and ETFs.

![]()

With YCharts, we’re able to better put our investment solutions in the context of the markets in a way that works for people on the go. It’s an incredibly analytical tool and saved us from having to build one in-house.

The Results

Although they’ve only utilized the YCharts platform for a short period of time, John Hancock's wholesalers are already finding that it’s leading to more success across the distribution team.

Matt recalls a recent example of a wholesaler on his team who built a number of client fund lists and Fund Screens within YCharts, to be used in preparation for a meeting. His presentation was so well received that each member of his team now leverages the workflow in their own conversations, and best of all, everything was shared amongst the team with a simple click.

“There is no doubt that YCharts is helping with client conversations,” Jeff said. “Our business consultants use it in the bulk of their meetings when discussing a specific fund opportunity.”

Matt also appreciates how easy-to-use and accessible YCharts is compared with other clunky, antiquated solutions, and loves how it’s enabling collaboration across the entire team.

“A big part of a territory’s success is the internal/external partnership,” said Matt. “YCharts helps those teams stay on the same page. The internals stress test the model portfolios that advisors are using and make recommendations for adjustments. When we take all that portfolio analysis that’s done internally and put it into the wholesaler’s fingertips, they’re more prepared for meetings and feel more informed.”

“I really see YCharts as a tool that can sync up many different parts of our organization,” Matt said. “From our distribution team to our capital markets team, I see it making a big impact on our collaboration as a whole.”

![]()

I really see YCharts as a tool that can sync up many different parts of our organization. From our distribution team to our capital markets team, I see it making a big impact on our collaboration as a whole.

Success Made With YCharts

Using YCharts as a sales enablement tool provides John Hancock’s distribution team with a platform to collaborate on fund comparison and portfolio analysis, as well as overcome challenges with advisors in real-time.