How Do I View Attribution by Options?

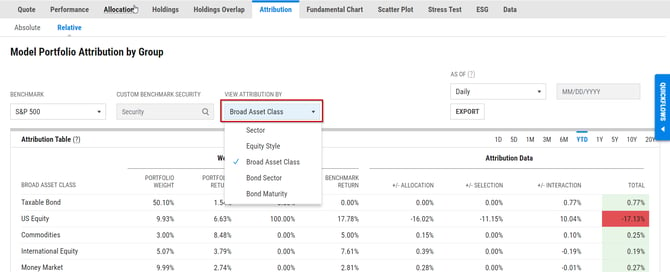

Relative Attribution Tab

The Broad Asset Class view will organize the direct holdings of the portfolio into their respective broad asset classes. From there, we’ll calculate the weights and the weighted average return of each asset class.

For Bond Sector and Bond Maturity, we’ll find the exposure of the portfolio into each grouping, but then use index proxies to calculate the performance of each group for both the portfolio and benchmark. The proxies used can be found below:

|

Bond Sector |

Performance Proxy |

|

Corporate |

Bloomberg US Corporate (^BBUSCOTR) |

|

Government |

Bloomberg US Treasury (^BBUSTTR) |

|

Municipal |

Bloomberg Municipal Bond (^BBMBTR) |

|

Securitized |

Bloomberg US Mortgage Backed Securities (^BBUSMBSTR) |

|

Other |

Bloomberg US Aggregate (^BBUSATR) |

|

Bond Maturity |

Performance Proxy |

|

1 to 3 years |

Bloomberg US Government/Credit 1-3 Year (^BBUGCR13YT) |

|

3 to 5 Years |

Bloomberg US Government/Credit 1-5 Year (^BBUGCR15YT) |

|

5 to 10 Years |

ICE US Treasury 7 - 10 Year Index Total Return (^ICEUT71YTR) |

|

10 to 20 Years |

ICE US Treasury 10-20 Year Index Total Return (^ICEUT12YTR) |

|

20 to 30 Years |

ICE US Treasury 20+ Year Index Total Return (^ICEUT2YTR) |

|

Greater than 30 Years |

Bloomberg US Long Government/Credit (^BBUSLGCRTR) |