How to Adjust Potential Tax in Portfolios

The Potential Tax affects the Tax Impact of your Transition Analysis. The default potential tax is set to 15%, but you can adjust this within your account by following the instructions below:

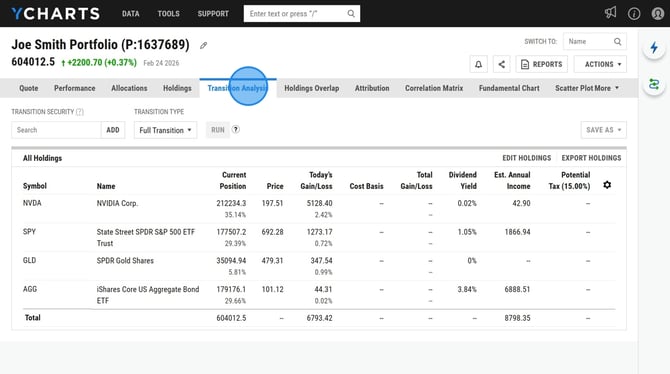

1. Open your portfolio and head to the Transition Analysis tab

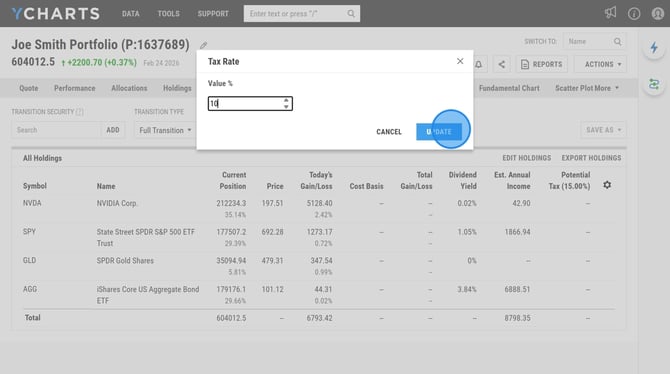

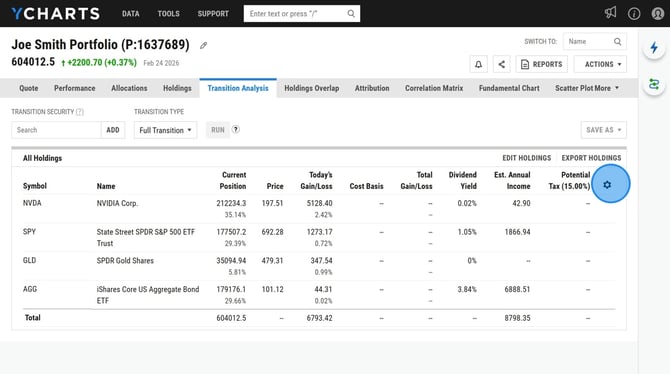

2. Click on the gear icon next to the Potential Tax field

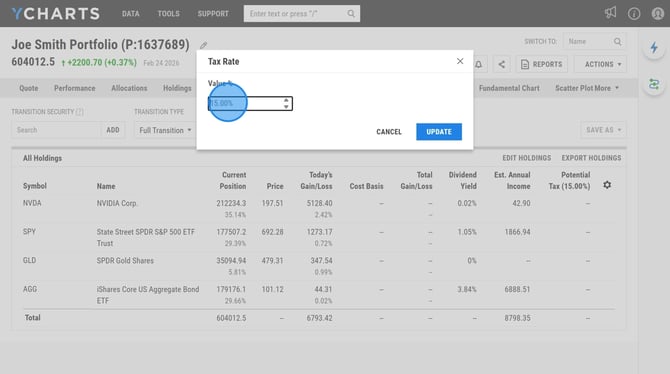

3. Adjust the tax value

4. Select Update