CASE STUDY

North Star Investment Management streamlines research workflows with YCharts screening tools.

About

North Star Investment Management is a multi-faceted firm providing investment management, financial planning, and mutual fund management, among a host of other services. Eric and Brooke Kuby are a father-daughter research team that work closely together on the firm’s two small-cap strategies, the North Star Micro Cap Fund (NSMVX) and the North Star Dividend Fund (NSDVX).

Eric Kuby has over 37 years of experience serving both individual and institutional clients. As Chairman of the Investment Committee, Eric oversees the firm’s various investment strategies and acts as portfolio manager for the firm’s various publicly traded funds. Eric holds an M.B.A. in Finance as well as a B.A. in Economics from The University of Chicago.

Brooke Kuby works across the North Star Fund Family in several functional areas including Equity Research and Marketing. She received her Bachelor of Science in Business Administration from the University of Southern California.

The Challenge

Prior to adding YCharts to their technology stack, North Star relied on ad-hoc processes to generate reports, update portfolio statistics, monitor investment performance, and conduct research. As a result, integral workflows were bogged down and disjointed.

The team also utilized a Bloomberg terminal for their investment research. While robust, the system was inherently hard to navigate and had a steep learning curve. This only further stymied their efficiency.

“Bloomberg is like a Ferrari, but they don’t ever show you how to drive it. Some things worked well, but it was hard to use if you weren’t already an expert,” says Eric Kuby.

Brooke also notes that she often spends hours generating reports and manually calculating portfolio statistics. The team needed an all-in-one tool that would make their work more efficient, while still providing robust data and functionality.

![]()

Bloomberg is like a Ferrari, but they don’t ever show you how to drive it. Some things worked well, but it was hard to use if you weren’t already an expert...With YCharts, it’s easy to look at a chart and understand immediately what you’re looking at.”

The Solution

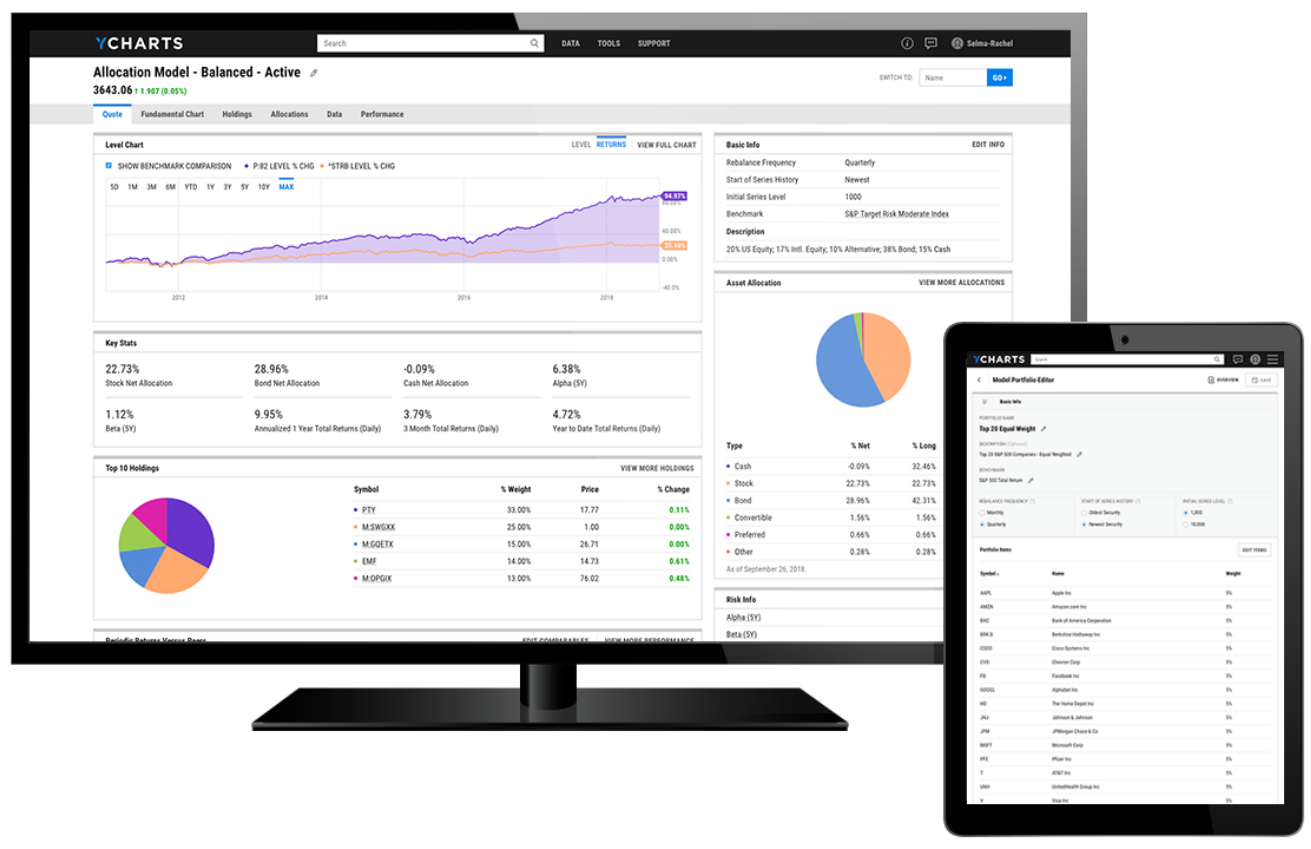

Enter YCharts. Since onboarding, the North Star team has leveraged YCharts to create weekly performance reports, generate Stock Screens and Fund Screens more efficiently, and track Model Portfolio statistics. Eric notes that when preparing for company management meetings or investment research conferences, YCharts’ quote pages create an intuitive path to relevant information. “I'll use the quote function and go to the company description, hit Key Stats to see what jumps out at me, and go from there to a company’s investor relations website.” Company quote pages also offer easy access to other company metrics, reports, and events, all of which is integrated with other YCharts tools such as Fundamental Charts and Scatter Plot.

Eric says the firm often leverages Fundamental Charts to show market trends and movements, and to present economic context during monthly investment committee meetings. Additionally, YCharts has provided Eric and Brooke with a way to save and share their research firm-wide. “Prior to YCharts, we didn’t have a system in place to save portfolio statistics. We would go to the SEC website and gather the information we needed, but we didn’t have a way to organize that data that was easily accessible for the rest of our team,” says Eric. "YCharts helped consolidate all of the information we needed in one place, so that we could seamlessly jump from researching a security to analyzing a portfolio’s performance.”

![]()

YCharts helped consolidate all of the information we needed in one place, so that we

could seamlessly jump from researching a security to analyzing a portfolio’s performance.

The Results

YCharts provides North Star with an array of tools and data, all of which have led to substantial time savings. It used to take the North Star team hours—or even days—to generate reports and portfolio statistics as they relied on unintuitive tools and manual calculations.

“Now it takes us less than five minutes, yet we gain hundreds if not thousands of insights,” says Brooke. They can also save their investment insights, whether in the form of a chart or Fund Screen, and easily share that information with the team. Better yet, the Kubys say the tool is user-friendly and generates easy-to-understand outputs for use with clients.

“We’re also doing monthly charting on high level items for the investment committee meeting. I can see the Russell 2000, S&P, QQQ on a fund chart then add MSFT or GOOGL to show how certain things may have driven movement,” says Eric.

He also explained how YCharts has helped create better touch points for North Star’s clients. “Something as simple as tracking a client's stock holdings via a Dashboard Watchlist can be a major value-add when servicing clients,” says Eric.

Brooke and her team regularly leverage insights from the Quarterly Economic Summary Deck, an additional resource for all YCharts users, when preparing for discussions with sophisticated institutional clients and prospects.

Success Made With YCharts

North Star Investment Management Corp leverages YCharts to optimize its investment research, create visually appealing and easy-to-understand client materials, and streamline firm-wide workflows.