CASE STUDY

Origin Zeroes In On Financial Goals With YCharts

About

Origin Wealth Advisers LLC is an independent, fee-only Registered Investment Adviser (RIA). Origin seeks to take wealth management back to its origin, when portfolios were not heavily traded, fees were disclosed and reasonable, and the portfolio manager stood for the client.

The Challenge

Do you want to retire comfortably? If so, good financial planning is essential.

For Morgen Beck CFA, founder of Origin Wealth Advisers, that means focusing on careful long-term investing to deliver principal appreciation and capital preservation. Origin’s clients are predominantly people in their 30s and 40s now, who want to retire in their 50s. “So we create a plan that covers every aspect of their individual financial situation,” explains Beck. “And from there I invest their assets to ensure they have the money in retirement to meet all their financial needs.”

Successful long-term value investing depends on identifying securities that will deliver the required performance-and that demands research.

Beck previously managed portfolios for high net worth investors at UBS Financial Services. So when she left UBS to launch Origin in August 2014, she knew she needed a high quality research tool. She approached all the major providers, but as a start up adviser found she couldn’t afford to use their services. Then a colleague recommended web-based research platform YCharts.

“I trialled the system, really liked it, and the price was right,” says Beck. “It has all the economic data points I want. Everything I could possibly need on an equity is there. I don’t have to go to EDGAR every time I want to pull individual security information, as it’s already at your fingertips. YCharts has pretty much everything, so I didn’t need to pay for a more expensive service.”

![]()

It has all the economic data points I want. Everything I could possibly need on an equity is there. I don’t have to go to EDGAR every time I want to pull individual security information, as it’s already at your fingertips.

The Solution

User-friendliness is another major advantage, says Beck. “You don’t really need any training to figure out how to use it. It’s all point and click. The search function is easy, and responds to typical words rather than specific commands. Plus it’s fast and accessible. As long as your internet connection is quick enough, YCharts will run really well.”

Beck’s value-oriented investment strategy is based on finding high quality securities, and then adopting a buy and-hold approach to minimize the impact that frequent trading costs have on performance. “I started as a trader, but I don’t think it’s a good way to help people achieve their long-term goals. I find my clients do better when I don’t trade much.”

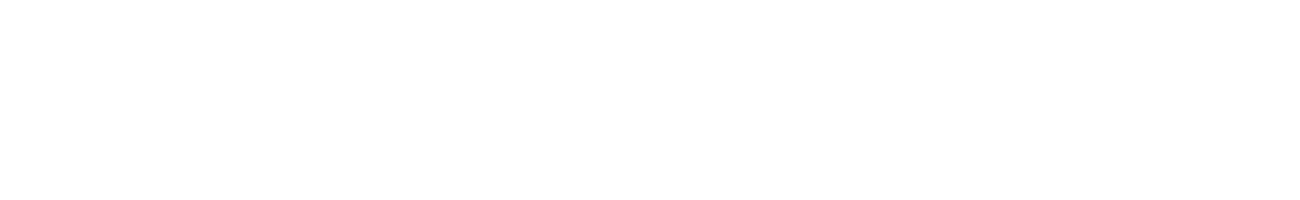

At Origin, Beck runs two portfolio types. The first is a passive, asset allocation-centered portfolio. The second also takes a strategic asset allocation approach, but with more of a core-satellite structure, where the core is invested in an index, with satellite investments in individual securities around it.

“I have it set up this way so clients get access to the market, but also benefit from a concentrated portfolio of individual names that I think will outperform,” she explains. While Origin maintains a low portfolio turnover, Beck is always searching for one or two new investment ideas a year. In the hunt for value, her focus is predominantly on smaller companies “because everybody is looking at the larger ones.”

![]()

You don’t really need any training to figure out how to use it. It’s all point and click. The search function is easy, and responds to typical words rather than specific commands.

The Results

“Each week I spend a lot of time sifting through ideas to find those two strong ones,” says Beck. “Using YCharts’ tools and data really helps screen securities I don’t even want to bother looking at, and then to whittle those down so I have a selection of names that if they hit my target price, I’m ready to get in.”

Along with choice security selection, another major part of Origin’s value-add comes from working with clients’ different personalities, and the behavioral aspects of private wealth management.

“By giving a lot of one-on-one attention to all my clients, I make sure they are always comfortable with the investment process and are doing what is necessary to achieve their goals,” says Beck.

Here again, YCharts is proving a powerful facilitator. “I run spreadsheets for each of my clients that show their overall portfolio across all their different accounts,” notes Beck. “By using YCharts’ Excel Add-In, I can run these large spreadsheets with near real-time pricing.”

Beck is able to further enhance her personalized service through YCharts’ data visualization capabilities.

“I can pretty much make a presentation chart with any of the data in the YCharts system, and brand it with my own logo. I use that a lot.”

This visualization flexibility is particularly valuable during any client interactions. “Before I walk into a meeting, I might prepare a selection of charts. Or if I’m on the phone with a client, I can quickly pull up a chart and email it to them,” Beck explains. “Clients really appreciate that because the information is laid out in an easy-to understand way for them. It also saves me a lot of time, which I can then spend with my clients instead of on digging up all this information. So they see a real benefit.”

In addition, Beck writes a monthly commentary, giving her insights into topical industry themes and market events. Using charts in those is an effective way to reinforce the point she is trying to make. “People tend to prefer to look at pictures rather than read words. So I’ve found that really helpful.”

And by posting the commentaries on Origin’s website and LinkedIn, Beck has been able to draw more web traffic, raise her profile, and attract potential clients.

![]()

Before YCharts, I had to make all of my own presentation materials, charts, and reports. Because the platform allows me to spend less time ‘in the past’, I can spend more time thinking about the future. I’ve been able to re-invest that newfound time into maintaining client relationships, marketing efforts, investment research, and growing the practice.

Success Made With YCharts

Morgen Beck, CFA, founder of Origin Wealth Advisers, leverages YCharts to visually narrate her portfolio strategies and performs securities research to provide for her clients a more personalized experience.