CASE STUDY

Meet Antonio Rodrigues, Partner and Senior Portfolio Manager at Procyon Partners

About

Procyon Partners is an independent RIA that serves high-net-worth private clients and retirement plan participants. Procyon’s institutional arm also helps organizations design, manage and enhance their retirement plan offerings. Having launched with Dynasty Financial Partners in 2017, the firm has quickly grown to serve more than 350 families and institutions, and advises over $3 billion in assets. With a client-first focus, Procyon works with each individual client to create a custom financial plan that helps them forge a path to their desired future.

The Challenge

2020 was undoubtedly a year to remember, and Procyon Partners certainly wasn’t immune to the influx of client inquiries that many RIAs experienced. As oil contracts reached negative territory, stay at home guidelines were put in place and the U.S. economy officially went into a recession in February 2020, it was critical that Procyon stood ready for any and all client questions. “

As you can imagine, we fielded a number of questions from clients outside of the norm,” shared Antonio Rodrigues, Partner and Senior Portfolio Manager at Procyon Partners.

As the coronavirus crisis and ensuing market selloff ended an 11-year bull run, client communication increasingly came into focus. Volatility brought concerned clients who may have never experienced challenging market conditions.

![]()

As the coronavirus crisis and ensuing market selloff ended an 11- year bull run, client communication increasingly came into focus. Volatility brought concerned clients who may have never experienced challenging market conditions.

The Solution

As a member of the Dynasty Network, Procyon Partners was well-prepared for the challenges that 2020 presented. With YCharts firmly entrenched in their technology stack since 2017, Antonio and the client-facing team at Procyon could quickly analyze securities that clients were asking about and share their insights with dynamic visuals. Combine that with the institutional-level support that Procyon receives from the Investments desk at Dynasty and the high-quality support they receive from YCharts, the firm armed itself with the resources to tackle any client inquiry.

“We’ve had a lot of clients inquire about companies that aren’t on our Recommended List or have ESG traits,” Antonio said. “The Fundamental Chart tool enables us to dig into historical performance, fundamental data points and balance sheet information to share self explanatory and easy-to navigate charts that answer client questions.”

At the onset of each client relationship, the Procyon team makes it a priority to cultivate a family-like environment. With predictable, cadenced communications, Procyon clients receive helpful content that is both relevant and timely. Each month, Procyon produces a market overview with a breakdown of asset class and style performance, in addition to their monthly client performance report.

In anticipation of market events, Procyon also prepares a commentary of what to expect and potential risks going forward.

Antonio attributes the live data on the YCharts platform, in addition to his spreadsheets powered by the YCharts’ Excel Add-in, as the engine that powers his analysis process. Whether he’s chairing an investment committee meeting or leading a Zoom video call with a client, Antonio knows he has the data he needs at his fingertips.

“Live data makes all the difference for me as one of the firm’s portfolio managers, and chair of the investment committee,” Antonio commented. “I can access YCharts from anywhere, on any device, and I know I’m going to have accurate data in near real-time.”

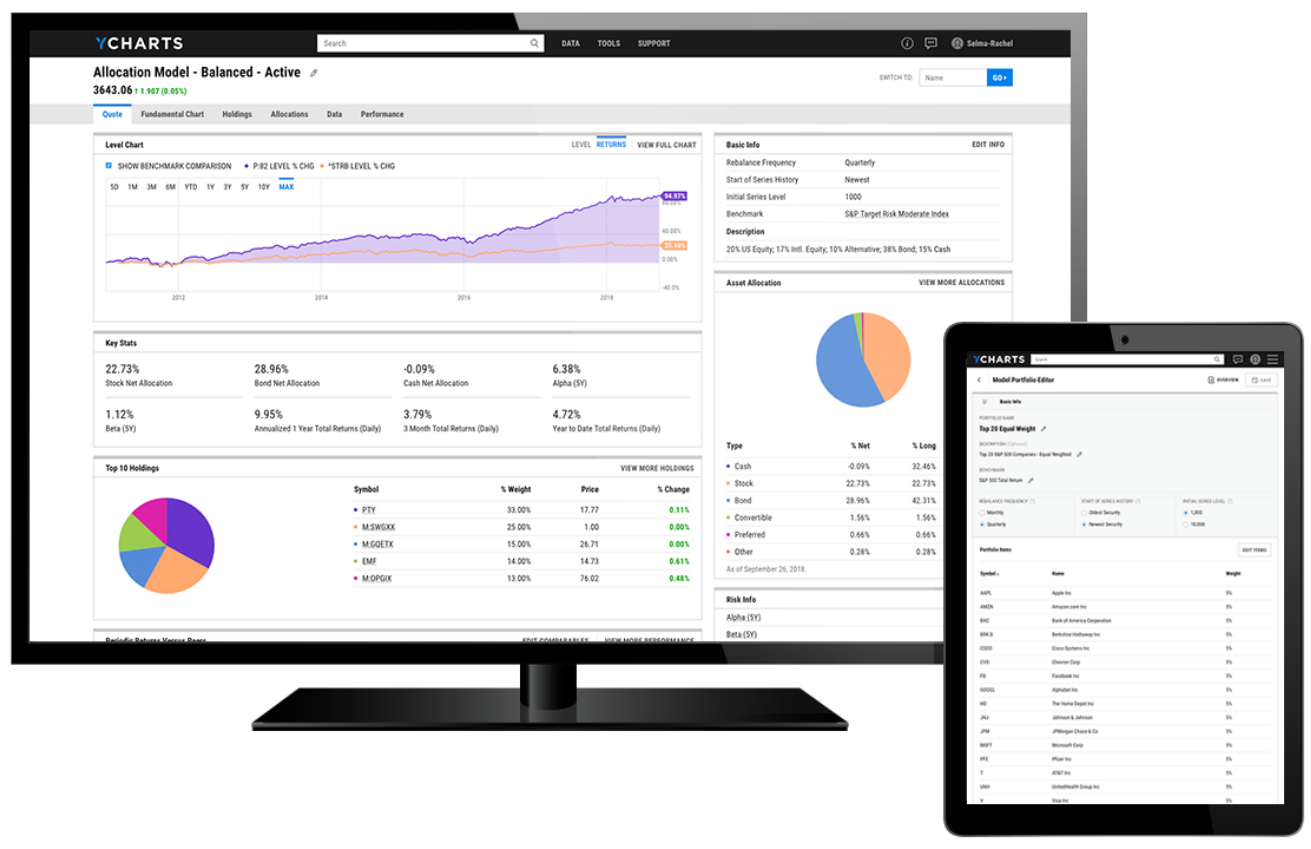

While Procyon utilizes Black Diamond for portfolio management and reporting, Antonio relies on YCharts’ Model Portfolios application to monitor live and historical model portfolio performance.

“To get a live picture of a model portfolio in some of our other tools takes a little bit more work than it should,” Antonio said.“YCharts helps us track our model portfolio ideas and do analysis on the models that we’re invested in. For example, if my basis is a 60/40 portfolio, I’m able to quickly see how that model relates to commodities or any security over a given timeframe.”

![]()

If my basis is a 60/40 portfolio, I’m able to quickly see how that model relates to commodities or any security over a given timeframe.

The Results

One word: Efficiency. Procyon Partners has become more efficient with their time after implementing YCharts across the firm. With Dynasty managing the firm’s back-office, Procyon has been able to optimize their resources while staying more aligned in their investment strategy.

“We use the YCharts Excel Add-in to update our Recommended List every day for our advisors and portfolio managers,” offered Antonio. “With all of the securities that we’re currently buying and monitoring in one place, we’re able to keep a close eye on our clients’ holdings.”

And with that data at their fingertips, the Procyon team has evolved and expanded their model strategies using the Model Portfolios tool. Procyon tracks their newly launched "Special Opportunities Fund:I" with YCharts Model Portfolios helping to share bimonthly communications with clients on sector allocations, holdings analysis, performance and risk.

I use a lot of fundamental data in my analysis, and one of the biggest value-adds for us is the ability to chart portfolio strategies against any number of benchmarks,” shared Antonio.

“I haven’t found many other tools where you can easily perform that analysis.”

Antonio believes YCharts is instrumental in helping Procyon serve clients. He loves how the Fundamental Charts tool provides clear and crisp visuals for client communications, the Excel Add-in leads to quicker, easier due diligence on securities, and that Model Portfolios enable timely tracking of model strategies.

“If you’re considering adding YCharts to your technology stack, it’s a no brainer!” Antonio said. “Through our partnership with Dynasty, we’re constantly evaluating the best technology tools in the space, and we’re delighted with the capabilities and efficiencies that YCharts has provided us.”

![]()

With all of the securities that we’re currently buying and monitoring in one place, we’re able to keep a close eye on our clients’ holdings.

Success Made With YCharts

Procyon Partners relies on YCharts’ dynamic tools and deep data to provide personalized, family-oriented service to their individual and institutional clients.