CASE STUDY

.png?width=900&height=250&name=Untitled%20design%20(78).png)

Savant Wealth Finds Its All-in-One Solution For Better Investment Analysis & Client Communication

About

Savant Wealth Management is a leading independent, nationally recognized, fee-only firm serving clients for over 30 years. As a trusted advisor and one of Barron's Top RIA firms, Savant Wealth Management offers comprehensive wealth management services, including investment management, tax planning, estate planning, and other services to financially established individuals and institutions. Gina Beall, CIMA® is Savant’s Director of Investment Research, has over 30 years of experience in the financial services industry, and is a MBA graduate of DePaul University.

Download YCharts for RIAs Fact Sheet

Researchers:

- Generate investment ideas

- Build, change, and push models to advisors in the field

Advisors:

- Access firm models

- Upload client and prospect portfolios for comparison

- Self-serve proposal generation needs

Compliance:

- Activate access controls

- Implement report templates • Set report disclosures at the firm level

The Challenge

As Savant’s array of financial services offerings grew over time, the organization found itself using many different systems for investment analysis, portfolio construction, market monitoring, charting, and client communication needs.

In addition, Savant's research team not only managed the firm’s model strategies on one platform, but was also responsible for servicing advisors’ proposal requests, a process that required a separate tool. This structure led to lengthy turnaround times of up to 5 business days for proposals, creating bottlenecks for advisors and the risk of losing new prospect business.

“We reached a point where managing multiple systems was no longer viable,” Gina says. “We needed a unified platform that could centralize these processes, empowering our advisors to act quickly and independently, while ensuring consistency across the firm.

Without a single tool or coordinated platform used across the organization, inefficiencies, operational challenges, and productivity losses arose related to manual processes. Savant was in need of a singular, unified platform capable of delivering model strategies and report templates from the home office to advisors nationally, while empowering those advisors to service and grow their books of business.

.png?width=720&height=300&name=Case%20Study%20Graphics%20(2).png)

The Solution

Enter YCharts, a consolidated software solution connecting research teams, advisors, and compliance divisions at large RIA firms.

“Scaling YCharts’ powerful platform across our teams is an invaluable asset to our operations, equipping our advisors with robust tools for personalizing client conversations and fostering collaboration essential for propelling organic growth”, says Gina.

Once Savant’s research team uploaded their models to YCharts, advisors were able to review allocations, analyze holdings data, and conduct stress tests. Advisors could also upload prospect portfolios and run proposals comparing existing portfolios to Savant models, significantly reducing reliance on the Research team.

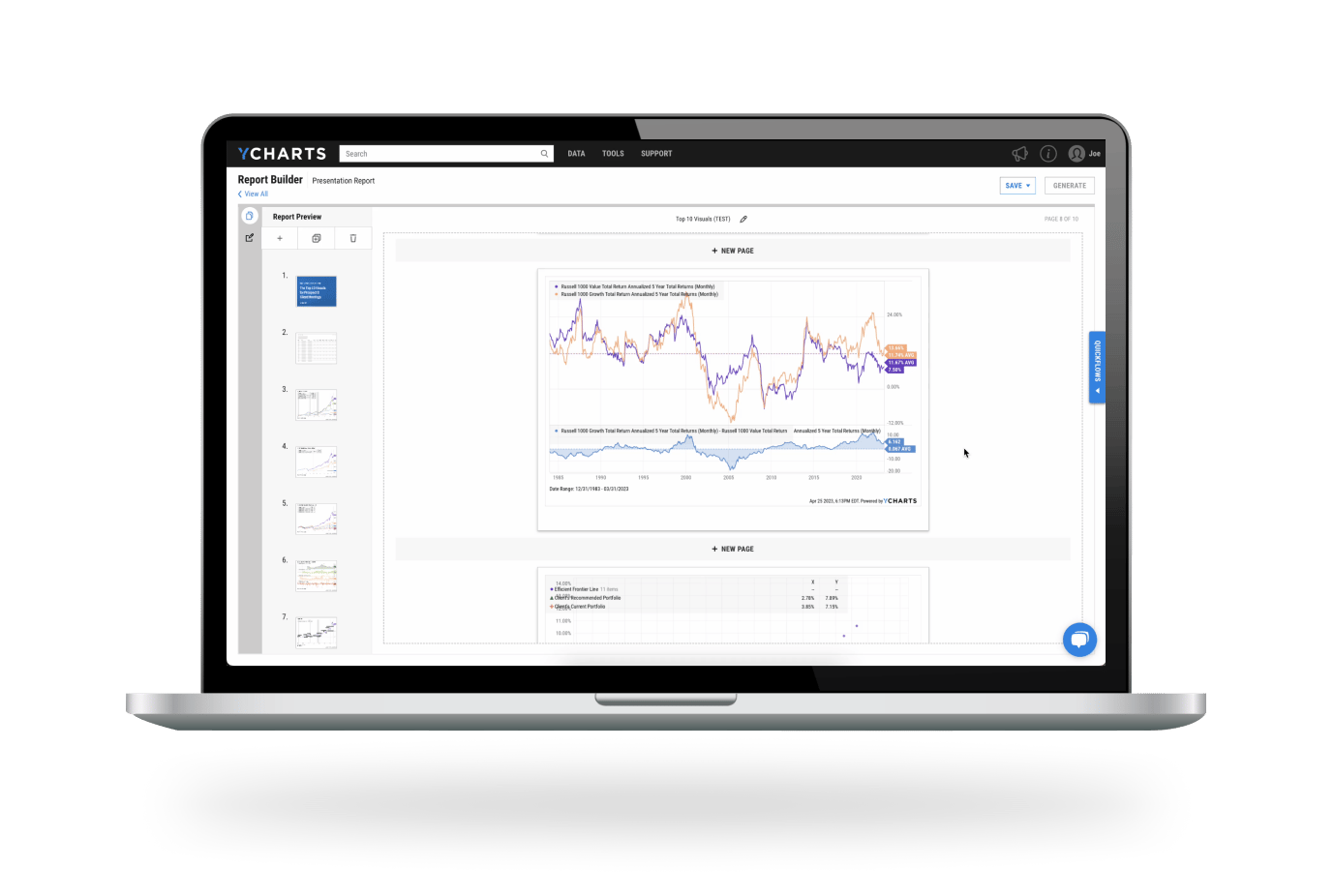

YCharts’ dedicated support team assisted Savant with setting up shared Dashboards for the firm’s advisors, which provided information about models, funds, and market data all in a single view. YCharts also worked with Savant to create tailored report templates that incorporate Savant marketing materials centered on the firm’s philosophy and approach, allowing for seamless, branded client deliverables that also meet compliance standards.

.png?width=720&height=300&name=Case%20Study%20Graphics%20(1).png)

The Results

The implementation of YCharts at Savant unlocked immediate efficiencies across the firm.

Before YCharts, advisors depended on the research team for proposal generation. After YCharts enabled advisors to self-serve their proposal needs, what used to be a 5-day process transformed into a speedy 10-minute exercise.

“With YCharts, the proposal generation process has been drastically cut to an average of just 10 minutes, allowing advisors to focus more on meaningful client engagement,” Gina said.

YCharts brought peace of mind to Savant's investment research team. The report templates created at the firm-level with custom disclosures and Savant marketing materials help ensure advisors deliver consistent, on-brand content that enhances client presentations and communications.

Streamlined onboarding helped advisors get up and running quickly on a turnkey platform containing Savant model strategies, dashboards, portfolios, and stress-testing capabilities. YCharts helped increase advisors’ autonomy, enabling them to provide faster, more comprehensive service to their clients.

“YCharts has not only streamlined our workflows but also empowered our advisors with the autonomy to provide faster, more comprehensive service to their clients. It’s been a key driver in supporting both operational efficiency and AUM growth.”

.png?width=720&height=300&name=Case%20Study%20Graphics%20(3).png)

Success Made With YCharts

Researchers and advisors across the country rely on YCharts to power their AUM growth, with one system for investment research, portfolio construction, model delivery, and proposal generation.

Tools used:

Proposals

Model Portfolios

Dashboard