CASE STUDY

Effiency Across the Board As SPEA Improves Research & Reporting Processes with YCharts

%20copy%202.png?width=1500&name=Influencer%20Circle%20Headshots%20(2)%20copy%202.png)

About

Kevin Silverman is CIO and Portfolio Manager at Sterling Partners Equity Advisors. He is responsible for selecting securities and managing portfolio strategies to ensure they are consistent with his client’s objectives and risk profiles. While he generally targets small-cap value securities, Kevin’s ultimate goal is to seek out the absolute best returns for his customers. He earned his BBA and MS in Finance from the University of Wisconsin-Madison. Kevin is also a CFA charter holder and committee member at the CFA Society of Chicago. He has over 30 years of experience in the financial services industry growth and some short-term profits from trading.

The Challenge

Kevin and his team at SPEA rely on fundamental data to perform their analysis and manage their clients’ portfolios. They had previously used Compustat to satisfy their financial, statistical, and market data needs, but found that the database had an overabundance of information that made it difficult to pinpoint what was relevant versus what was surplus.

“I was looking for a robust investment research platform that offered efficient, comprehensive datasets that would allow me to find the information I needed without compromising on speed or data quality,” said Kevin. “But at the same time, I also didn’t want to pay for Bloomberg or FactSet either.”

As part of SPEA’s process, the firm heavily leverages Excel-based models to derive investment insights, build strategies, and inform stock selection. Kevin wanted a platform that would not only be able to export datasets into user-friendly workbooks but also integrates with existing models to allow for more automation and less manual data entry.

![]()

I was looking for a robust investment research platform that offered efficient, comprehensive datasets that would allow me to find the information I needed without compromising on speed or data quality. But at the same time, I also didn’t want to pay for Bloomberg or FactSet either.

The Solution

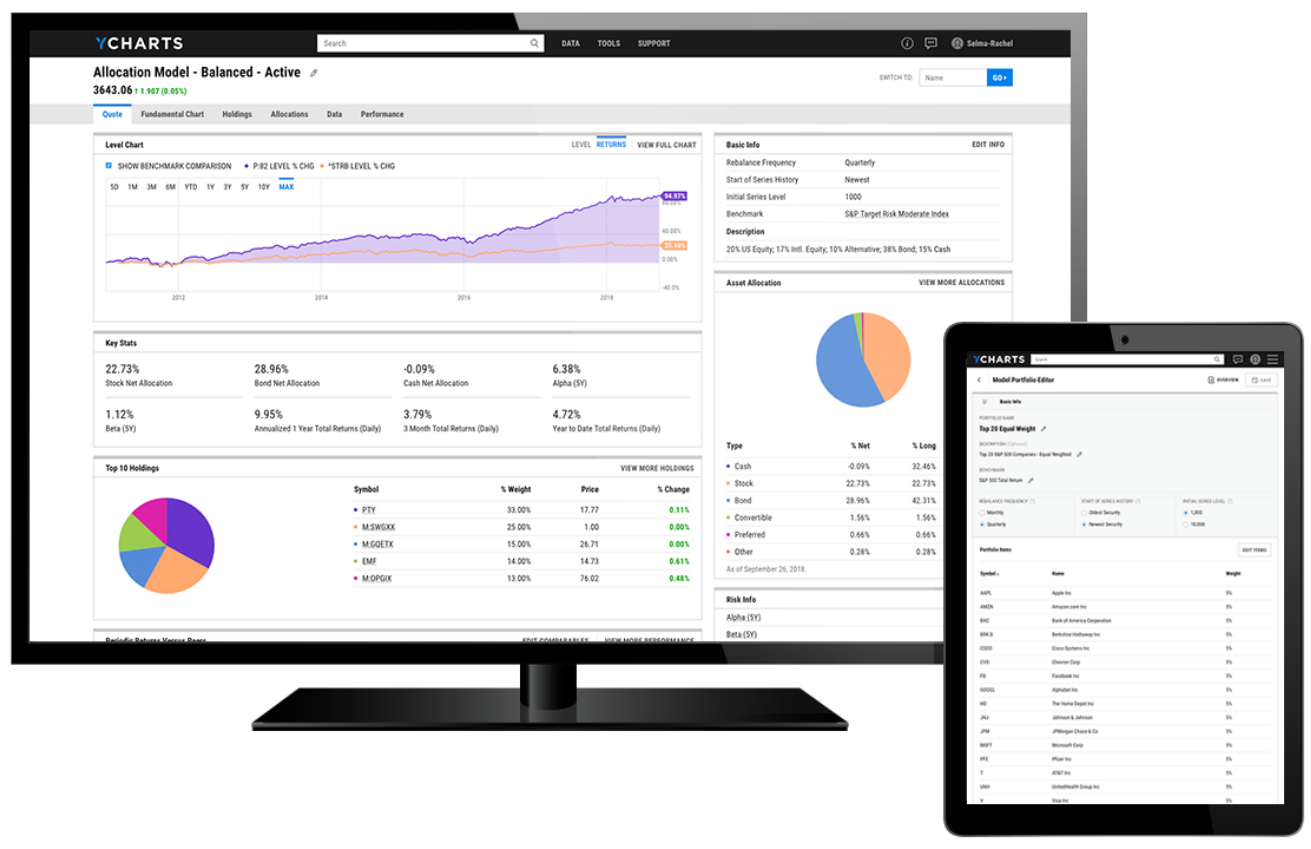

Kevin first stumbled upon YCharts through social media and was intrigued by its easy-to-digest visuals. After conducting additional research into the platform, the combination of YCharts’ Excel Add-In capabilities and the reasonable price point won him over. While these were initial selling points, the platform’s simple and intuitive form factor, which is customizable to put the data Kevin needs front-and-center, kept him coming back.

“When I started using YCharts, one of the first things I noticed was its flow and how intuitive it was to navigate. Finding information was easy, and I didn’t need a manual or any significant guidance or training as I would for a Bloomberg Terminal or FactSet,” noted Kevin on his initial impression of YCharts.

“Not only that, but I appreciate the fact that YCharts smartly and proactively manages its datasets. It’s not trying to prove that it has everything under the sun. The information the platform does provide is straightforward and doesn’t overwhelm its users,” said Kevin.

“Since I’ve been a customer, YCharts’ data continues to grow and address my needs and those of other advisors,” he adds. Kevin and his team have applied YCharts’ datasets to their proprietary models and built out tailored strategies based on their clients’ risk profiles and financial goals.

Kevin also noted that when it comes to his experience with the humans behind YCharts, the customer success team, he’s always had a positive interaction. “The attitude the YCharts team has towards its customers is similar to the level of service one would experience from the concierge at the Four Seasons,” Kevin said of YCharts’ white-glove service. “I often get a personal call back shortly after reaching out.”

Additionally, he enjoys YCharts’ cloudbased system and its ability to work across multiple devices. These factors allow him to easily start a project on his laptop and pick up where he left off on his tablet or phone.

![]()

When I started using YCharts, one of the first things I noticed was its flow and how intuitive it was to navigate. Finding information was easy, and I didn’t need a manual or any significant guidance beforehand like I would for a Bloomberg Terminal or FactSet.

The Results

Kevin powers his idea generation and selection using the Stock Screener. As the first step of his process, he makes good use of the tool’s flexibility. “I’m most interested in company metrics such as revenue, total assets, and price-to-book, and then I apply various profitability metrics to narrow down the universe,” states Kevin. He will also use YCharts’ prebuilt templates to jumpstart his research, with the Ben Graham Value Stock and Joel Greenblatt Value screens being his favorites. Kevin adds that the screener is “simple to use and helps me identify 10-20 securities of interest, save them to a Watchlist, and subsequently perform additional research.”

Kevin’s next step entails drilling down into each individual stock’s quote page to better understand its fundamentals. He then combines those initial findings into visuals with Fundamental Charts.

“I’ll drop in one of my saved watchlists, and YCharts instantly creates a set of charts for me to click through, comparing each opportunity head-to-head. It’s so efficient and easy to do!” Kevin said of YCharts’ ability to streamline his process. In addition to using Fundamental Charts as an analysis tool, he also leverages it for client presentations. “Whenever I’m meeting with a client, I always know I’ll be able to create a chart in just a few mouse clicks,” said Kevin. “Charts are a huge time-saver and empower my clients to analyze and interpret the data for themselves. It’s much simpler than looking at a standalone data table.”

Perhaps his most-used tool on the platform, Kevin leverages YCharts’ Excel Add-In to construct fact sheets based on specific risk classes for his presentations.

“A lot of the fact sheets I use were originally created via Macros I wrote in Excel, but more recently I’ve started to build out my portfolio reporting using the readily available templates in YCharts and tailoring them for my clients.”

Speaking of the depth and breadth of data in YCharts, Kevin says, “Metrics and datasets that used to be my ‘secret weapon’ are now readily available to anyone using the platform. YCharts continues to push the envelope and our industry so that we continue to grow and become better investment analysts.” He added, “I also appreciate that YCharts takes into account advisor feedback and incorporates it into future updates. I’ve enjoyed watching the platform’s progression and growth and look forward to seeing its continued evolution."

Since implementing YCharts into SPEA’s tech stack, the firm has continued to build on their success and was recently recognized as Manager of the Decade after earning the Top Guns designation by PSN/Informa Financial Intelligence.

“Before YCharts, I had to make all of my own presentation materials, charts, and reports. Because the platform allows me to spend less time ‘in the past’, I can spend more time thinking about the future,” said Kevin. “I’ve been able to reinvest that newfound time into maintaining client relationships, marketing efforts, investment research, and growing the practice.”

![]()

Before YCharts, I had to make all of my own presentation materials, charts, and reports. Because the platform allows me to spend less time ‘in the past’, I can spend more time thinking about the future. I’ve been able to re-invest that newfound time into maintaining client relationships, marketing efforts, investment research, and growing the practice.

Success Made With YCharts

As Sterling Partners Equity Advisors’ CIO and Portfolio Manager, Kevin Silverman leverages YCharts to identify securities of interest, perform comprehensive research and analysis, and streamline the creation of client reports and presentations.