CASE STUDY

StrategIQ Financial Group, LLC rely on YCharts to streamline their portfolio construction and analyses to better educate and serve their clients.

About

Meet Brad Rathe, AIF®, and David Keller of StrategIQ Financial Group. Brad has over 25 years of experience in the financial services industry and has served as StrategIQ Financial Group’s Chief Investment Officer since 2012. He manages a team of 20+ researchers and analysts and focuses on macro-level research where he takes an objective, quantitative approach to making investment decisions for his clients. David is one of StrategIQ’s financial analysts and traders, and assists Brad with sector and equity research, generating new investment ideas, and building out client portfolio strategies.

The Challenge

![]()

I needed a tool that allowed me to write my own code for databasing purposes, but also one that would be easy-to-use, but, more importantly, easy to learn so my team could get up and running as quickly as possible.

The Solution

StrategIQ Financial Group came across YCharts in 2015. Early in his time at SFG, Brad had the chance to speak to an early YCharts team member, understand the long-term vision and overall growth plan for the platform, and immediately saw its potential. “It has been a fruitful partnership as YCharts continues to address SFG’s needs and continues to keep pace and push the boundaries of what an investment research tool should be,” said Brad.

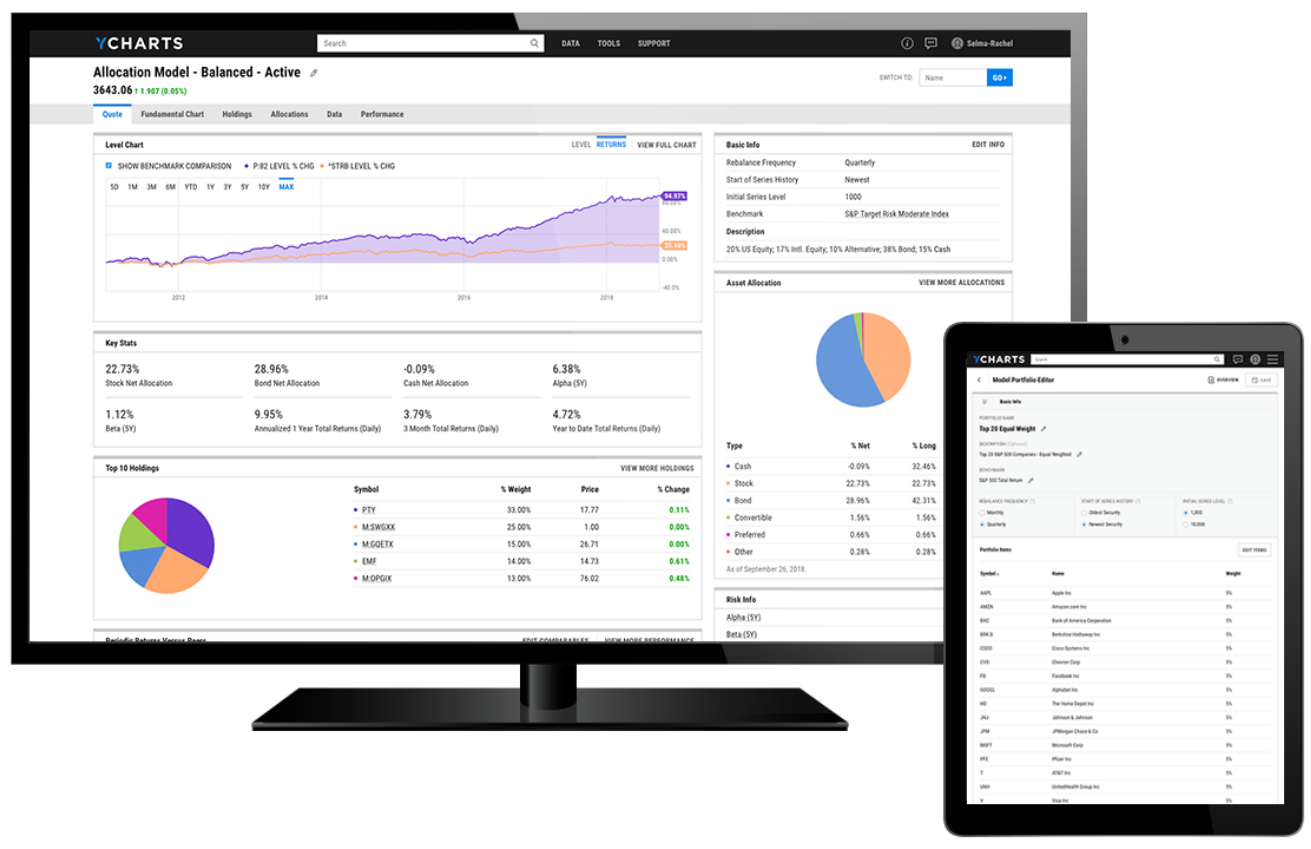

Praising YCharts’ evolution with the additions of Dynamic Model Portfolio and Custom Securities, “YCharts has built an investment research platform with advisors in mind. The platform is lean and mean, creating tools with the highest impact to provide the most value to their customers,” noted Brad. Combined with its comprehensive datasets, YCharts fosters significant time-savings for SFG by making daily

operations more efficient. “With YCharts, I never wonder whether or not I can find the information I need,” added David. “I have everything at my fingertips, and I don’t worry about having to explore other resources to find a specific security or dataset.”

Brad appreciates the YCharts customer success team’s proactive outreach to inform him of any new features that would be useful to him and his team. “Our customer support rep would periodically reach out to schedule brief 20-minute meetings to review new features, highlighting ones that were relevant specifically for us.” He added that, “their responsiveness, helpfulness, and willingness to find a solution when SFG runs into a wall is unmatched. They are reliable, and we always know they’ll deliver a solution that meets our needs.”

![]()

YCharts has built an investment research platform with advisors in mind. The platform is lean and mean, creating tools with the highest impact to provide the most value to their customers.

The Results

Since implementing YCharts into StrategIQ’s tech stack, the Excel Add-In has been a favorite and often leveraged feature, opening the door to deeper portfolio and securities analysis. “I wouldn’t consider myself a coding wizard, but YCharts makes it easy for me to understand and learn the coding schema,” says David, referencing the Excel Add-In’s straightforward syntax. “As a whole, YCharts’ ease of use and intuitive site navigation are better than anything I’ve seen in the past.”

Brad adds that YCharts’ pre-built Excel templates have provided his team significant value and are good starting points when constructing portfolios for his clients. “The quick reference guide and templates are huge time savers for us,” says Brad. “The templates available get me 90% of the way to where I want to be, then I’ll tack on the last 10% that’s tailored to a client’s goals and risk profile.” He adds that the user-generated FINRA-reviewed Portfolio Overview and Portfolio Comparison reports have also been huge timesavers when communicating with clients.

In David’s role at SFG, he performs more micro-level, granular investment research. With its easy-to-navigate form factor, YCharts enables him to be more efficient every step of the

way. “YCharts’ predictive search results make for an enjoyable user experience. Whether I’m searching for a security or a specific financial metric, I don’t have to spend time hunting for it. Everything is just there,” David says, referring the platform’s comprehensive and accessible datasets. He also found that YCharts’ Quickflows tool is great for jumpstarting his research and generating new ideas, specifically when performing a deep dive into a single company or comparing multiple portfolios.

StrategIQ Financial Group was an early adopter of YCharts and has seen the platform evolve alongside its business, growing its assets under management from $250M to nearly $2B since implementing YCharts.

“Simplifying the complex and nailing the ease-of-use is what YCharts does best. The platform’s interface and accessibility are top tier and really simplifies finding the data without substituting the breadth or scale of the information needed,” said David. Brad added, “If you’re more of a quantitative advisor, building strategies, looking at technical fundamental factors, and building models regularly, this is the tool you need to have. If you use data to make decisions, this is as easy as it gets.”

![]()

Simplifying the complex and nailing the ease-of-use is what YCharts does best. The platform’s interface and accessibility are top tier and really simplifies finding the data without substituting the breadth or scale of the information needed.

Success Made With YCharts

Bradley Rathe, CIO, and David Keller, Financial Analyst/Trader, at StrategIQ Financial Group, LLC rely on YCharts to perform comprehensive investment research, generate new investment ideas, and streamline their portfolio construction and analyses to better educate and serve their clients.