CASE STUDY

Sungarden Cultiavates Investment Success With YCharts

About

Sungarden Investment Research is a discretionary money manager running multiple investment styles using proprietary hedged investing strategies. Sungarden invests in stocks for income/longterm capital appreciation, and inverse ETF securities to hedge against major market declines.

The Challenge

For Sungarden Investment Research, helping clients achieve successful investment outcomes is as much about playing strong defense as good offense. To create the desired balance, Sungarden uses proprietary hedged investing strategies to manage volatility and avoid “big” losses investing in stocks for income and/or long term capital appreciation depending on each client’s unique objectives, while buying inverse ETF securities to hedge against major market declines.

“People come to us, and tend to stay with us, because of our ability to manage money and service our clients’ accounts. By managing money in-house, we keep costs down, while enabling clients to talk directly to the decision makers,” says Rob Isbitts, Sungarden’s Co Founder and Chief Investment Strategist. “But as a discretionary money manager running multiple styles, it is essential we have a high- end research suite to support our portfolio management capabilities.”

Sungarden’s previous research provider had a reasonable database, but it was not web-based or as flexible to use as the firm wanted, says Isbitts.

“The main issue was that we weren’t able to access it as cleanly as we wanted. We couldn’t just log in to a website, or use it on our phones and tablets. I’m dedicated to good practice management, and get annoyed when I feel there is a better way to do something."

For Sungarden, that better way is web-based research platform YCharts.

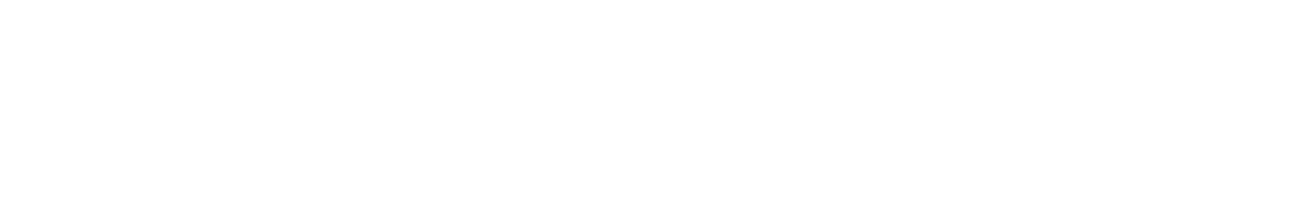

Isbitts is a big believer in investing in improving his firm’s technology if it delivers good value. The initial thought behind assessing an alternative research provider was “maybe we can get more for less,” explains Isbitts. “YCharts is actually less expensive. And it was evidently designed more recently than some of the older, better known systems. The customizable dashboard allows us to track so many different elements, which means we can easily run our daily research activities on it.”

![]()

Powering investment research and performance, and improving client experience and service—for Sungarden, YCharts does it all.

The Solution

The number one feature that attracted Sungarden to YCharts was the ability to chart many different data points on a stock, such as the price/earnings ratio or dividend yield, as well as the stock price.

“For example, we do a lot of dividend investing, and created a concept called YARP—Yield at a Reasonable Price,” says Isbitts. “So if a stock was yielding 3%, it sold off and is now yielding 4.5%, but we think the business is in solid shape, to us that is like buying something on sale. With YCharts we can instantly see where a stock is trading versus its yield history, as well its price history. It’s not as easy to track those movements on other systems.”

Sungarden has also been able to strengthen and institutionalize its proprietary stock selection technique. “Our rating system takes into account a multitude of data points on a stock, and is the foundation of our research method,” explains Isbitts. “I’ve been trying for 20 years to create a robot version of my thought process that can act as an automated independent check.”

![]()

YCharts is crucial not only in powering our investment research, but in enabling us to share our thinking in a way that is easy for people to understand.

The Results

Using the fundamental analysis capabilities within YCharts, Sungarden can now collate 60 or 70 different metrics of a stock in one place. The team then determines each metric’s importance within its dividend or growth portfolios, weights each data point accordingly, and calculates a rating score.

“It has allowed us to take the dream of our own rating system and finally make that a reality,” says Isbitts

Alongside its investment approach, the firm seeks to distinguish its services through its diverse library of client communications. The focus is on providing clear and frequent communications on relevant topics – such as explaining changes to the portfolio and updates on market events—to further educate and inform clients about what is happening with their assets and the wider market.

One element is the monthly Investment Climate Report, which aims to provide an easy to-understand overview of the market conditions that impact clients’ wealth. “It’s sort of an indicator of indicators, a macroinvesting version of our stock selection system,” Isbitts explains.

“We take 10 or 11 different items that help us gauge the valuation and momentum level of the broad stock market to decide how optimistic or pessimistic to be. Formulating the indicator is quite complex, but YCharts provides us with a lot of different data that we use to create that.”

Isbitts also produces a weekly MarketWatch column that addresses relevant current issues. “The stock rating analysis I set out in the articles couldn’t happen if it were not for the YCharts data and API,” he notes.

In the three years since Sungarden began using YCharts, it has become the start and end point for improving the firm’s client experience and service, says Isbitts. “YCharts is crucial not only in powering our investment research, but in enabling us to share our thinking in a way that is easy for people to understand.”

In an increasingly complex investment world, that is an enormous advantage.

![]()

Before YCharts, I had to make all of my own presentation materials, charts, and reports. Because the platform allows me to spend less time ‘in the past’, I can spend more time thinking about the future. I’ve been able to re-invest that newfound time into maintaining client relationships, marketing efforts, investment research, and growing the practice.

Success Made With YCharts

For Sungarden Investment Research, YCharts is crucial in not only powering its investment research but also enabling it to share its thinking in a way that is easy for people to understand.