Email Reports

Get updates on what you want, when you want.

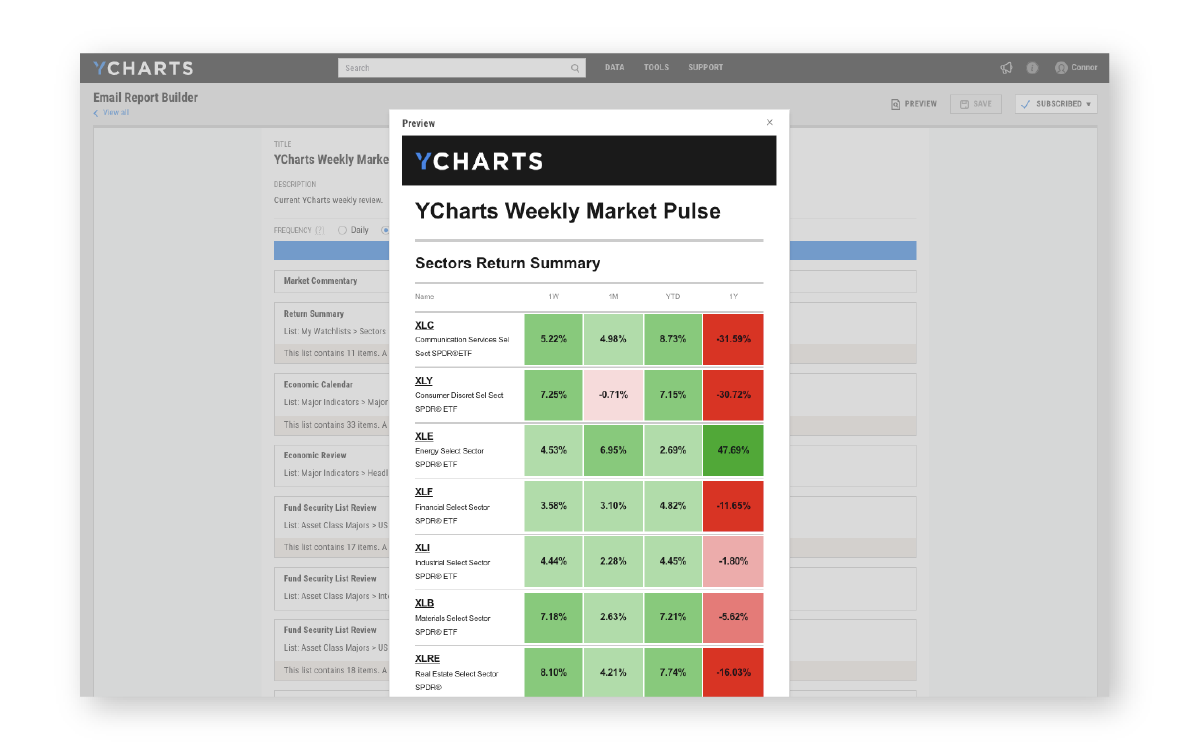

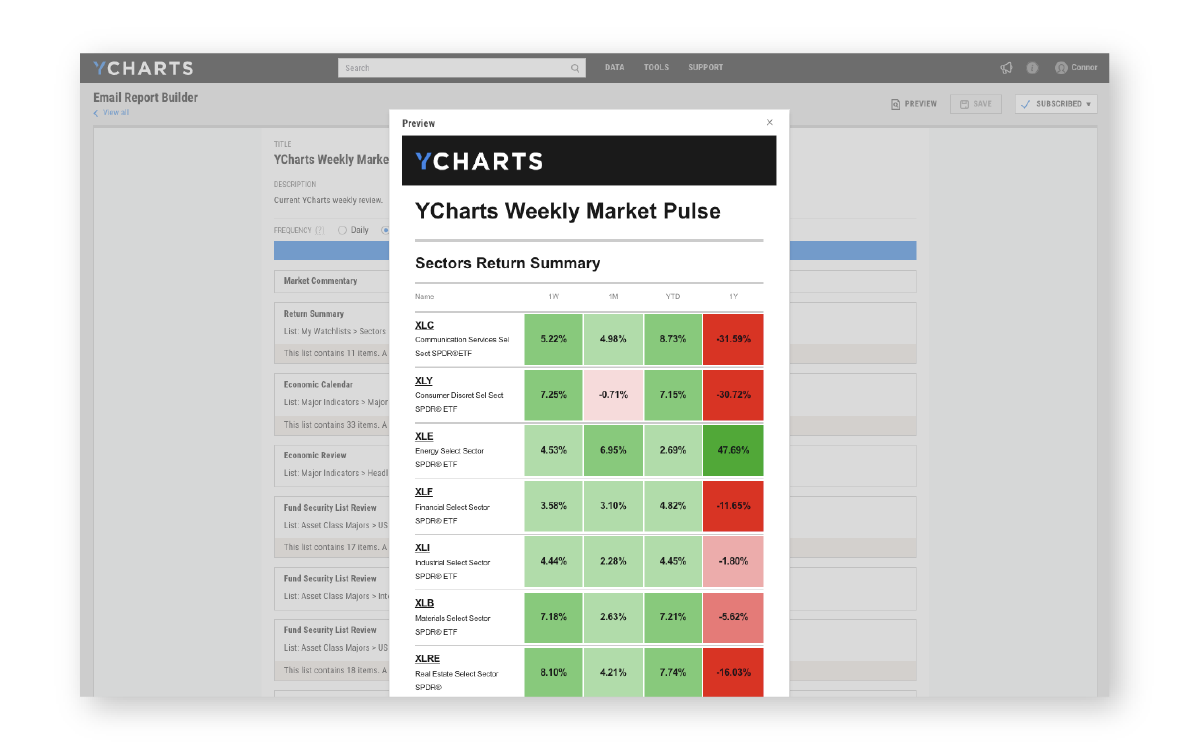

Monitor key holdings, benchmarks & indicators

Customize your view of summary data on key holdings, investment opportunities, market benchmarks and macro indicators with Email Reports. Add performance visuals and more utilizing Fundamental Charts or even add data tables to show absolute performance or compare securities’ returns against a benchmark.

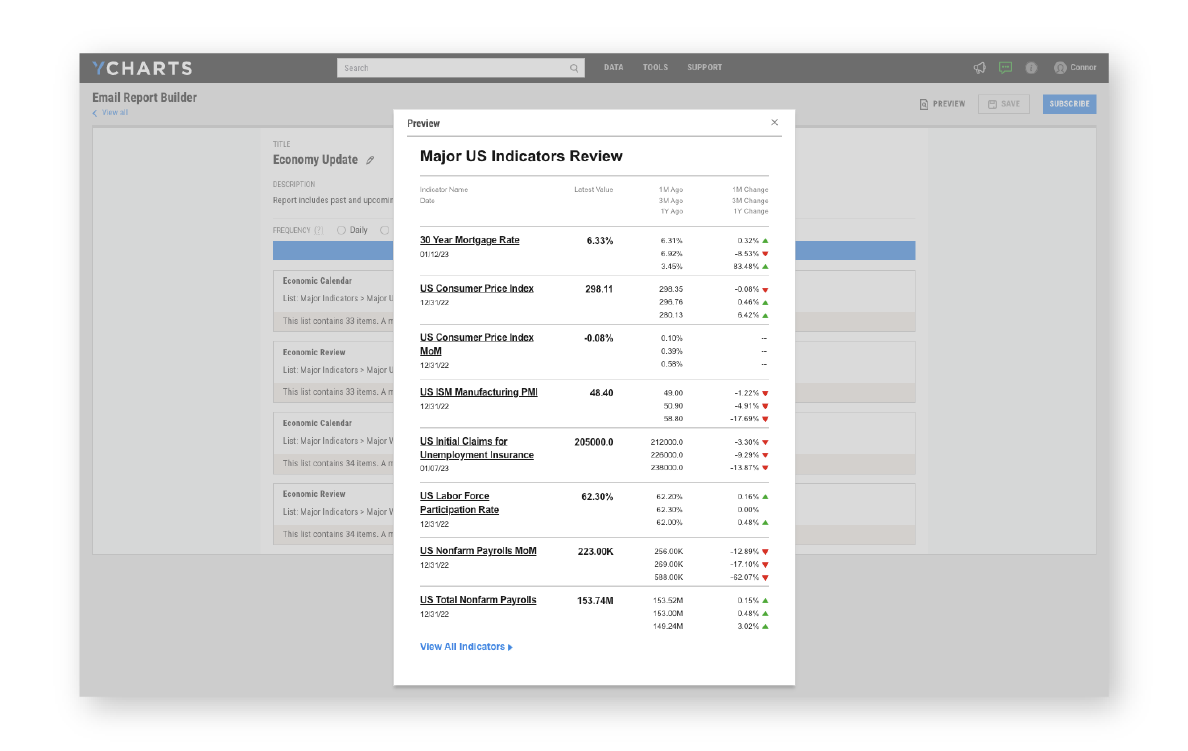

Stay informed of market events and trends

Important events often affect the risk a position may carry during a trading session. Custom Email Reports keep you up-to-date on earnings calls, dividends & announcements for your most important holdings, plus the latest economic data as reported by the Fed, Bureau of Labor Statistics, and others.

Create touch points with your clients & prospects

Build personalized reports using the drag and drop email builder to provide targeted information on major holdings, engaging clients in a simple and personalized way. Schedule updates at daily, weekly, monthly, or quarterly intervals and leverage pre-built templates to streamline the entire process.